August 14, 2024 8:30 AM EDT | Source: TNR Gold Corp.

Vancouver, British Columbia–(Newsfile Corp. – August 14, 2024) – TNR Gold Corp. (TSXV: TNR) (“TNR“, “TNR Gold” or the “Company“) is pleased to announce that McEwen Mining Inc. (“McEwen Mining“) has provided an update on the Los Azules copper, gold and silver project in San Juan, Argentina. TNR holds a 0.4% net smelter returns royalty (“NSR Royalty“) (of which 0.04% of the 0.4% NSR Royalty is held on behalf of a shareholder) on the Los Azules Copper Project. The Los Azules project is held by McEwen Copper Inc. (“McEwen Copper“), a subsidiary of McEwen Mining.

The news release issued by McEwen Mining on August 8, 2024, stated:

“McEwen Copper Inc., 48.3% owned by McEwen Mining Inc. (NYSE, TSX), is pleased to comment on the excitement in Argentina that includes:

Infill Drill Highlights:

AZ24375: 217 meters of 1.11 % Cu, incl. 100 meters of 1.32 % Cu

AZ24335: 158 meters of 0.84 % Cu, incl. 78.5 meters of 1.10 % Cu

AZ24403: 276 meters of 0.86 % Cu, incl. 160 meters of 0.96 % Cu

AZ24320: 146 meters of 0.89 % Cu

AZ24332: 119.6 meters of 0.72 % Cu

Remarkable new legislation introduced by President Milei to encourage large domestic and foreign investments in the country;

A US$4.4 Billion transaction led by BHP, the world’s largest mining company, and Lundin Mining to acquire two copper deposits located in the same province in Argentina as Los Azules;

At Los Azules, infill drilling during the 2023-24 season upgraded the resource categories, validated the geological model and confirmed the high-grade zone. Resource drilling for the Los Azules Feasibility Study is now complete, and the study remains on track for delivery in early 2025.

Remarkable and Welcoming Legislation – Milei Magic

President Milei’s government introduced legislation that has rolled out the welcome mat for large-scale domestic and foreign direct investments in Argentina.

This legislation recently approved by Argentina’s government is called “Bases and Starting Points for the Freedom of Argentines” and includes the Incentive Regime for Large Investors (RIGI), offering significant tax and foreign exchange incentives to encourage domestic and direct foreign investment in key sectors of the economy, including mining.

This program addresses most of all past stumbling blocks for sustained development of the mining sector in Argentina, and it’s a huge step in the right direction.

We are excited about these changes as they open the door for many infrastructure investments in Argentina and significantly improve the economics of the Los Azules project and lower risks for investors. Details of the legislation are found in Appendix A – More Information on RIGI and you can click here for the official summary.

US$4.4 Billion Copper Transaction

Last week, BHP, the world’s largest mining company, and Lundin Mining announced a US$4.4 Billion transaction through which they have agreed to jointly acquire the two copper deposits Filo del Sol and Josemaria located in the same San Juan province of Argentina as Los Azules.

We believe that this transaction is a convincing demonstration of San Juan and Argentina’s attractiveness for large-scale mining projects and evidence of Argentina moving towards becoming a Tier 1 mining jurisdiction. Click on these links to read details of the transaction, in press releases by BHP, Lundin Mining, and Filo Corp.

Los Azules Infill Drilling Highlights Confirming High Grade Copper Zone

At Los Azules, infill drilling upgraded the resource categories, validated the geological model and confirmed the high-grade zone. During the 2023-24 drilling season over 70,000 meters (m) were completed, that have strengthened the interpretation of the geological model in addition to extending the supergene enrichment zone mineralization, both at the edges and to depth.

Resource drilling for the Los Azules Feasibility Study is now complete, and the study remains on track for delivery in early 2025.

Drilling Highlights

Hole AZ24375, drilled to a depth of 369 m, returned 217 m of 1.11 % Cu in the enriched zone, including 100 m of 1.32 % Cu.

Hole AZ24335, drilled to a depth of 227.5 m, returned a 158 m intercept of 0.84% Cu within the enriched zone, including 78.5 m of 1.10 % Cu.

Hole AZ24403, drilled to a depth of 427 m, returned a 276 m intercept of 0.86% Cu within the enriched zone, including 160 m of 0.96 % Cu.

Hole AZ24320, drilled to a depth of 204 m, returned 146 m of 0.89% Cu in the enriched zone.

Hole AZ24332, drilled to a depth of 255.6 m, returned 119.6 m of 0.72% Cu in the enriched zone.

The 2023-2024 drill campaign successfully achieved its objective of infilling existing drill hole data to support the conversion of resources to Measured or Indicated Mineral Resources to include in the Los Azules Feasibility Study. In addition, geotechnical, metallurgical, hydrogeological and condemnation drilling was carried out.

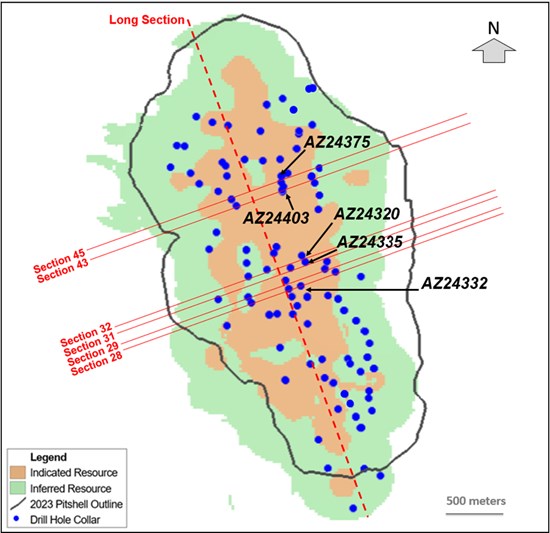

The locations of the highlighted results are presented in 8 figures. A plan or aerial view of the resources and the outline of the PEA pit are shown in Figure 1. Figures 2 to 7 show recent drilling in relation to the overburden, the leached, enriched and primary zones, and the 30-year pit shell of the 2023 Preliminary Economic Assessment (PEA) (marked by the green line in the sections). Figure 8 represents a cross section with recent drill data and inferred geology.

Drill results and location information for this press release are available in Appendix B – Detailed Data From the 2023-2024 Drilling Campaign at Los Azules.

Figure 1 shows a plan view of the location of the sections and drill holes reported in this press release. All cross sections are 50 m equidistant from each other, with the lowest numbered section starting from the southern end of the deposit. Shown in blue are the collars of the drill holes included in this news release.

Figure 1 – Plan View Location of Cross-sections and Drill Holes Reported in This News Release

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2014/219860_623ac0c6d4e19ab1_003full.jpg

The section marked on Figure 1 by the red dashed line is presented in Figure 2 as the longitudinal view looking northeast and indicating the location of the reported holes. Note the position of the highlighted holes within the zone of enriched (or supergene) mineralization and how they mostly ended in mineralized material, indicating the potential for mineralization to continue at depth. The length of the enriched zone on this section is 3.9 kilometers. The enriched zone now continues beyond the southern limit of the PEA mineable pit shell.

Figure 2 – Longitudinal Section (Looking Northeast)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2014/219860_623ac0c6d4e19ab1_004full.jpg

Figure 3 shows a 217 m intercept of 1.11 % Cu (AZ24375) and includes a 100 m interval of 1.32% Cu within the enriched zone. This hole infills a data gap within the center of the deposit and confirms the continuity of higher-grade mineralization.

Figure 3 – Section 45 – Drilling, Mineralized Zones and 30-Year PEA Pitshell (Looking Northwest)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2014/219860_623ac0c6d4e19ab1_005full.jpg

Figure 4 shows an intercept of 276 m of 0.86 % Cu (AZ24403) that includes 160 m of 0.96% Cu in the enriched zone. This hole also infills a drilling gap in the center of the deposit with higher grade mineralization.

Figure 4 – Section 43 – Drilling, Mineralized Zones and 30-Year PEA Pitshell (Looking Northwest)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2014/219860_623ac0c6d4e19ab1_006full.jpg

Figure 5 shows a 146 m intercept of 0.89 % Cu (AZ24320). The drill hole extends high grade mineralization to the west of a previously drilled hole (AZ22152MET).

Figure 5 – Section 32 – Drilling, Mineralized Zones and 30-Year PEA Pitshell (Looking Northwest)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2014/219860_623ac0c6d4e19ab1_007full.jpg

Figure 6 shows an intercept of 158 m of 0.84 % Cu (AZ24335) that includes 78.5 m of 1.10% Cu within the enriched zone. The drill hole ended in mineralized material, indicating the potential for mineralization to continue at depth within the enriched zone, as indicated by previously released drill holes.

Figure 6 – Section 31 – Drilling, Mineralized Zones and 30-Year PEA Pitshell (Looking Northwest)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2014/219860_623ac0c6d4e19ab1_008full.jpg

Figure 7 shows a 119.6 m intercept of 0.72 % Cu (AZ24332) in the enriched zone. This hole extends the higher-grade mineralization seen previously in AZ23309 in the central portion of the enriched zone towards the east and at depth.

Figure 7 – Section 28 – Drilling, Mineralized Zones and 30-Year PEA Pitshell (Looking Northwest)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2014/219860_623ac0c6d4e19ab1_009full.jpg

Geological Model – Interpretation and Its Relationship with the Copper Mineralization

Geological understanding of the Los Azules deposit has increased significantly with the drilling performed from 2022 to 2024. A series of copper-bearing early and inter-mineral porphyry dikes and hydrothermal magmatic breccias are cutting across a pre-mineral diorite intrusive. The dikes dip steeply to the east in their northwest-southeast orientations.

All rock types contain variable copper mineralization, depending on their position within the deposit’s vertical profile. From top to bottom, the zoning includes leached, supergene (enriched) and primary (hypogene), which are characteristic of many porphyry copper deposits worldwide.

Hypogene mineralization, associated with the early mineral porphyry and proximal host rock, is characterized by a stockwork of abundant type A veinlets containing quartz, pyrite, and chalcopyrite. In much of the deposit’s footprint, mineralization encountered at depth strongly indicates the potential to extend further, beyond 1,000 meters.

The supergene copper enrichment process created higher grades in the early mineral porphyry and associated hydrothermal magmatic breccias, and lower grades in the less permeable pre-mineral pluton and inter-mineral porphyries. The supergene mineralization will be the principal mineral feed for the leach pad for the Feasibility Study.

In Figure 8 Section 29 shows, in its central part, the early mineral porphyry (purple color) intruding or cutting the pre-mineral diorite (light green color). To a lesser extent, thin inter-mineral porphyry dikes (light blue color), affect both the early mineral porphyry and the pre-mineral diorite. The early mineral porphyry is the primary source of copper mineralization in the deposit.

Figure 8 – Recent Drill Data and Inferred Geology in Cross Section 29

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2014/219860_623ac0c6d4e19ab1_010full.jpg

Technical Information

The technical content of this press release has been reviewed and approved by Darren King, Director of Exploration of McEwen Copper, who serves as the qualified person (QP) under the definitions of National Instrument 43-101.

All tasks, including the collection of samples for geochemical analysis, were carried out in accordance with generally accepted mining industry standards. Drill core samples were analyzed by Alex Stewart International laboratory, located in the Province of Mendoza, Argentina, whose assays consisted of: gold analysis by fire fusion assay and an atomic absorption spectroscopy finish (Au4-30); multiple element studies by ICP-OES analysis (ICP-AR 39); determination of copper content by sequential copper analysis (Cu-Sequential LMC-140). In addition, and for samples with high sulfide content (Cu, Ag, Pb and Zn) and exceeding the limits of analysis, an ICP-ORE type analysis was performed.

The company is conducting a quality control/assurance program in accordance with NI 43-101, and industry best practices, using a combination of standards and blanks on approximately one out of every 25 samples. Results are monitored as final certificates are received and any re-assay requests are sent immediately. Analysis of pulp and preparation samples is also performed as part of the quality control process. Approximately 5% of the sample pulps are sent to a secondary laboratory for control purposes. In addition, the laboratory performs its own internal quality control checks, and the results are made available on certificates for company review.

ABOUT MCEWEN COPPER

McEwen Copper is a well-funded, private company that owns 100% of the large, advanced-stage Los Azules copper project, located in the San Juan province, Argentina. McEwen Copper is a 48.3%-owned private subsidiary of McEwen Mining, which trades under the ticker MUX on NYSE and TSX.

Los Azules is being designed to be distinctly different from a conventional copper mine by consuming significantly less water, emitting much lower carbon, progressing towards carbon neutral by 2038, and being powered by 100% renewable electricity once in operation. The updated Preliminary Economic Assessment (PEA) released in June 2023 projects a long life of mine, short payback period, low production cost per pound, high annual copper production, and a 21.2% after-tax IRR.

ABOUT MCEWEN MINING

McEwen Mining is a gold and silver producer with operations in Nevada, Canada, Mexico, and Argentina. McEwen Mining also owns a 48.3% interest in McEwen Copper, which is developing the large, advanced-stage Los Azules copper project in Argentina. The Company’s objective is to improve the productivity and life of its assets with the goal of increasing the share price and providing investor yield. Rob McEwen, Chairman and Chief Owner, has a personal investment in the companies of US$225 million. His annual salary is US$1.

Appendix A

– More Information on RIGI –

The RIGI grants a series of benefits in tax, customs and foreign exchange regulations for investment projects in the mining sector that comply with the requirements set up by the law.

The main requirements for beneficiaries of RIGI are as follows:

The amount for an investment to qualify within the regime will be >US$200 million, as determined for different industries by the regulations.

Export projects with investments greater than US$1 billion are considered strategic and have additional benefits.

At least 40% of the minimum amount must be invested in the first two years.

The regime will be open to applications for 2 years. The application period can be extended for 1 more year. The investment can be completed after the application period.

The use of incentives may require collateral.

The Los Azules project is believed to be able to meet all criteria to be considered a strategic project under the terms of the RIGI legislation.

The main benefits to the beneficiaries of the RIGI are the following:

1. Income Tax

Corporate income tax rate is reduced from the current 35% to 25%.

Equipment is subject to accelerated depreciation in 2 years, and infrastructure and cost of mine in 60% of its useful life.

Net Operating Losses (NOLs) can be carried forward without a time limit. After a 5-year carry forward, NOLs can be transferred (sold) to third parties. NOLs are adjusted for inflation.

Interest is deductible without limitations during the first 5 years even when the lender is foreign related party.

Dividend payments are subject to tax at 7%, which will be reduced to 3.5% after 7 years.

In the case of Strategic Export projects, payments to foreign beneficiaries for technical assistance are not subject to withholding tax. Other payments to foreign beneficiaries are capped at 10.5% withholding with no grossing up.

2. Value Added Tax (VAT)

Rather than paying VAT on purchases, the beneficiaries of the RIGI will provide its suppliers with Tax Credit Certificates. The Tax Credit Certificates can also be used to pay the VAT generated by imports of equipment. This prevents from tying up funds as VAT credits to be recovered against future exports. Implementation of this benefit will require extensive regulation.

Suppliers may use the certificates to offset their VAT obligations and, if there is a VAT credit left to recover, they may transfer (sell) the VAT credit to third parties.

3. Other Taxes

The beneficiaries of the regimen will have a 100% tax credit for the amounts paid for Bank Transactions Tax to offset the income tax obligations.

Provinces and Municipalities cannot establish new taxes affecting the projects, except for service fees that do not exceed the cost of the service provided to the beneficiary.

4. Imports

Freedom to import without quotas or restrictions.

Exemption from import duties on capital goods, spare parts, parts, components and consumables.

5. Exports

Freedom to export the products produced by the project.

Exemption from export duties after three years of registration. The exemption applies for two years in Strategic Export projects.

Maximum Principal gross revenue royalty of 5% (at the discretion of the Province).

6. Foreign Exchange Regime

Foreign proceeds from exports are freely available: 20% of proceeds after two years of the commencement of production; 40% after three years, and 100% after four years onwards.

In the case of a Strategic Export project, the foreign proceeds are freely available as follows: 20% of proceeds after one year of the commencement of production; 40% after two years, and 100% after three years onwards.

Foreign proceeds from external financing are freely available. Foreign assets abroad do not generate foreign exchange restrictions.

Free access to the foreign exchange market for the repayment of loans, repatriation of investments, payment of interests and dividends, conditional on the investment or loan having been entered through the exchange market.

7. Stability Safeguards

Beneficiaries are also granted tax, customs and foreign exchange stability for 30 years from joining the RIGI. In the case of Strategic Export projects developed in stages, stability can be extended up to 40 years from the commencement of production of the first stage.

The safeguards offered by the stability have these main features:

Tax stability applies by tax and not by total tax burden. It also applies to withholding taxes on payments to foreign beneficiaries. In the event of an increase in taxes, the beneficiaries of the regimen may reject the payment of the tax exceeding stability or pay the tax and use the amount of the tax paid as a tax credit against any other national tax. A breach of stability is presumed (it is not necessary to prove it) if it comes from a legal or regulatory change. In the case of tax reduction, the beneficiaries can automatically take advantage of it.

Customs stability includes a mechanism that allows the beneficiaries to make a manual self-assessment applying the stabilized duties instead of the automatic calculation by the customs system.

Foreign exchange stability protects against regulations imposing more burdensome or restrictive conditions. The law allows beneficiaries to reject the application of the new rule. The Central Bank cannot initiate criminal proceedings without first carrying out a process to determine whether the exchange stability applies to the case.

Dispute Resolution

Disputes can be resolved by administrative proceedings or international arbitration outside Argentina. Arbitration can be initiated, even if the administrative procedure has not been completed.

The arbitration is to be done outside of Argentina, under the rules of the PCA, ICC or ICSID, with arbitrators who are neither Argentine nor nationals of the investor’s country.”

Appendix B

– Detailed Data From the 2023-2024 Drilling Campaign at Los Azules –

Table 1 – Recent Los Azules Drilling Results

Hole-ID

Section

Predominant Mineral Zone

From

(m)

To

(m)

Length

(m)

Cu

(%)

Au

(g/t)

Ag

(g/t)

Comment

AZ24316

26

Total

111.0

315.5

204.5

0.63

0.05

1.23

Enriched

111.0

293.0

182.0

0.64

0.05

1.22

Incl. 123 m of 0.8% Cu

Primary

293.0

315.5

22.5

0.26

0.00

1.70

AZ24317

56

Total

107.0

305.0

198.0

0.18

0.03

0.61

Enriched

107.0

305.0

198.0

0.18

0.03

0.61

Primary

AZ24318MET

50

Total

124.0

229.5

105.5

0.70

0.05

2.53

Enriched

124.0

229.5

105.5

0.70

0.05

2.53

Incl. 12 m of 1.44% Cu

Primary

AZ24319

35

Total

160.0

355.0

195.0

0.45

0.04

0.96

Enriched

160.0

332.0

172.0

0.48

0.04

1.04

Incl. 84 m of 0.51% Cu

Primary

332.0

355.0

23.0

0.27

0.03

0.36

AZ24320

32

Total

58.0

204.0

146.0

0.89

0.05

1.67

Enriched

58.0

204.0

146.0

0.89

0.05

1.67

Primary

AZ24321

30

Total

117.0

389.8

272.8

0.60

0.05

1.32

Enriched

117.0

389.8

272.8

0.60

0.05

1.32

Incl. 12 m of 0.85% Cu

Primary

AZ24322

44

Total

144.0

491.0

347.0

0.43

0.06

1.78

Enriched

144.0

491.0

347.0

0.43

0.06

1.78

Incl. 130 m of 0.57% Cu

Primary

AZ24323

26

Total

86.0

184.6

98.6

0.19

0.01

0.64

Enriched

86.0

184.6

98.6

0.19

0.01

0.64

Primary

AZ24324

34

Total

108.0

343.0

235.0

0.37

0.02

0.36

Enriched

108.0

322.0

214.0

0.40

0.02

0.37

Incl. 12 m of 0.92% Cu

Primary

322.0

343.0

21.0

0.12

0.02

0.30

AZ24325

25

Total

76.0

338.0

262.0

0.19

0.02

0.65

Enriched

76.0

266.0

190.0

0.21

0.02

0.65

Primary

266.0

338.0

72.0

0.14

0.02

0.64

AZ24326

26

Total

108.0

331.0

223.0

0.42

0.05

1.30

Enriched

108.0

256.0

148.0

0.52

0.07

1.47

Incl. 57.7 m of 0.59% Cu

Primary

256.0

331.0

75.0

0.23

0.03

0.95

AZ24327

31

Total

78.0

316.0

238.0

0.38

0.03

1.10

Enriched

78.0

316.0

238.0

0.38

0.03

1.10

Primary

AZ24328

48

Total

126.0

231.0

105.0

0.08

0.02

1.13

Enriched

126.0

231.0

105.0

0.08

0.02

1.13

Primary

AZ24329

29

Total

90.0

332.0

242.0

0.24

0.03

0.89

Enriched

90.0

290.0

200.0

0.25

0.03

0.96

Primary

290.0

332.0

42.0

0.17

0.02

0.56

AZ24330

56

Total

164.0

185.0

21.0

0.70

0.03

1.26

Enriched

164.0

185.0

21.0

0.70

0.03

1.26

Primary

AZ24332

28

Total

136.0

255.6

119.6

0.72

0.06

1.72

Enriched

136.0

255.6

119.6

0.72

0.06

1.72

Primary

AZ24334

48

Total

104.0

657.0

553.0

0.42

0.07

2.94

Enriched

104.0

412.0

308.0

0.50

0.08

3.53

Incl. 60 m of 0.71% Cu

Primary

412.0

657.0

245.0

0.32

0.06

2.21

AZ24335

31

Total

69.5

227.5

158.0

0.84

0.10

0.98

Enriched

69.5

227.5

158.0

0.84

0.10

0.98

Incl. 78.5 m of 1.10% Cu

Primary

AZ24336CC

8a

Total

218.0

501.0

283.0

0.20

0.08

1.93

Enriched

218.0

370.0

152.0

0.25

0.14

2.76

Primary

370.0

501.0

131.0

0.14

0.02

0.91

AZ24338

5a

Total

252.0

729.5

477.5

0.19

0.02

0.88

Enriched

252.0

490.0

238.0

0.23

0.04

0.97

Primary

490.0

729.5

239.5

0.14

0.01

0.78

AZ24339CC

12a

Total

140.0

517.5

377.5

0.16

0.02

0.68

Enriched

140.0

470.0

330.0

0.17

0.02

0.67

Primary

470.0

517.5

47.5

0.11

0.01

0.74

AZ24340

26

Total

66.0

300.5

234.5

0.50

0.04

1.04

Enriched

66.0

300.5

234.5

0.50

0.04

1.04

Incl. 72 m of 0.78% Cu

Primary

AZ24341

48

Total

87.0

261.5

174.5

0.57

0.07

1.09

Enriched

87.0

261.5

174.5

0.57

0.07

1.09

Primary

AZ24342

28

Total

81.0

235.5

154.5

0.39

0.05

2.82

Enriched

81.0

235.5

154.5

0.39

0.05

2.82

Primary

AZ24343

58

Total

71.0

365.6

294.6

0.17

0.01

0.67

Enriched

71.0

344.0

273.0

0.18

0.01

0.70

Primary

344.0

365.6

21.6

0.07

0.00

0.30

AZ24344

43

Total

140.0

312.0

172.0

0.43

0.05

1.50

Enriched

140.0

312.0

172.0

0.43

0.05

1.50

Incl. 52 m of 0.62% Cu

Primary

AZ24345

44

Total

80.7

291.2

210.5

0.37

0.02

1.98

Enriched

80.7

190.0

109.3

0.55

0.02

1.68

Incl. 66 m of 0.66% Cu

Primary

190.0

291.2

101.2

0.17

0.02

2.31

AZ24346

40

Total

44.0

196.6

152.6

0.06

0.00

0.64

Enriched

44.0

100.0

56.0

0.07

0.00

0.33

Primary

100.0

196.6

96.6

0.06

0.00

0.83

AZ24347

14

Total

88.0

295.8

207.8

0.30

0.05

0.90

Enriched

88.0

286.0

198.0

0.30

0.05

0.94

Primary

286.0

295.8

9.8

0.15

0.06

0.30

AZ24348

40

Total

168.0

373.7

205.7

0.20

0.01

0.56

Enriched

168.0

373.7

205.7

0.20

0.01

0.56

Primary

AZ24349

22

Total

98.0

356.0

258.0

0.44

0.04

1.27

Enriched

98.0

339.4

241.4

0.46

0.04

1.31

Incl. 84 m of 0.78% Cu

Primary

339.4

356.0

16.6

0.20

0.03

0.63

AZ24350

30

Total

96.0

224.0

128.0

0.10

0.02

1.01

Enriched

96.0

154.0

58.0

0.12

0.03

1.21

Primary

154.0

224.0

70.0

0.08

0.02

0.85

AZ24351A

29

Total

110.0

449.4

339.4

0.29

0.03

1.52

Enriched

110.0

400.0

290.0

0.31

0.03

1.69

Primary

400.0

449.4

49.4

0.12

0.01

0.51

AZ24352

12

Total

168.3

379.3

211.0

0.34

0.05

0.67

Enriched

168.3

358.0

189.7

0.36

0.05

0.56

Primary

358.0

379.3

21.3

0.13

0.03

1.62

AZ24353

46

Total

90.0

338.5

248.5

0.35

0.04

1.85

Enriched

90.0

320.0

230.0

0.37

0.04

1.96

Primary

320.0

338.5

18.5

0.12

0.00

0.52

AZ24354

42

Total

194.0

331.0

137.0

0.14

0.01

0.71

Enriched

194.0

331.0

137.0

0.14

0.01

0.71

Primary

AZ24355

56

Total

84.5

288.5

204.0

0.23

0.01

0.87

Enriched

84.5

288.5

204.0

0.23

0.01

0.87

Primary

AZ24356

56

Total

51.0

205.5

154.5

0.70

0.15

3.79

Enriched

51.0

108.0

57.0

0.17

0.04

1.43

Primary

108.0

205.5

97.5

1.01

0.21

5.14

Incl. 30 m of 2.84% Cu

AZ24357

22

Total

152.0

386.0

234.0

0.21

0.02

2.51

Enriched

152.0

302.0

150.0

0.24

0.02

0.45

Primary

302.0

386.0

84.0

0.17

0.02

6.18

AZ24358

36

Total

70.2

264.5

194.3

0.23

0.01

0.57

Enriched

70.2

188.0

117.8

0.18

0.01

0.53

Primary

188.0

264.5

76.5

0.31

0.00

0.62

AZ24360

24

Total

84.0

335.5

251.5

0.21

0.02

0.89

Enriched

84.0

258.0

174.0

0.25

0.02

0.87

Primary

258.0

335.5

77.5

0.12

0.02

0.93

AZ24361

12

Total

220.0

335.2

115.2

0.42

0.06

1.37

Enriched

220.0

308.0

88.0

0.49

0.07

1.35

Incl. 28 m of 0.68% Cu

Primary

308.0

335.2

27.2

0.17

0.03

1.45

AZ24362

34

Total

76.0

309.0

233.0

0.34

0.01

1.01

Enriched

76.0

309.0

233.0

0.34

0.01

1.01

Primary

AZ24363

48

Total

96.0

335.6

239.6

0.18

0.01

0.71

Enriched

96.0

250.0

154.0

0.20

0.00

0.57

Primary

250.0

335.6

85.6

0.14

0.01

0.96

AZ24364

51

Total

92.0

215.4

123.4

0.21

0.03

0.82

Enriched

92.0

215.4

123.4

0.21

0.03

0.82

Primary

AZ24365

55

Total

118.0

291.5

173.5

0.40

0.01

1.32

Enriched

118.0

291.5

173.5

0.40

0.01

1.32

Incl. 10 m of 0.89% Cu

Primary

AZ24366

22

Total

182.0

328.2

146.2

0.17

0.02

0.78

Enriched

182.0

298.0

116.0

0.19

0.02

0.91

Primary

298.0

328.2

30.2

0.10

0.01

0.25

AZ24367

50

Total

94.0

433.5

339.5

0.32

0.05

1.30

Enriched

94.0

400.0

306.0

0.32

0.06

1.30

Primary

400.0

433.5

33.5

0.26

0.04

1.34

AZ24368

4

Total

138.0

220.5

82.5

0.21

0.03

0.52

Enriched

138.0

220.5

82.5

0.21

0.03

0.52

Primary

AZ24369A

48

Total

122.0

248.0

126.0

0.61

0.05

1.14

Enriched

122.0

248.0

126.0

0.61

0.05

1.14

Incl. 58 m of 1.01% Cu

Primary

AZ24370

8

Total

156.0

290.0

134.0

0.39

0.04

0.53

Enriched

156.0

262.0

106.0

0.44

0.05

0.60

Incl. 20 m of 0.81% Cu

Primary

262.0

290.0

28.0

0.22

0.04

0.25

AZ24371

36

Total

98.0

302.1

204.1

0.31

0.03

0.74

Enriched

98.0

290.0

192.0

0.32

0.03

0.77

Primary

290.0

302.1

12.1

0.16

0.00

0.25

AZ24372

10

Total

155.7

298.2

142.5

0.38

0.06

0.99

Enriched

155.7

298.2

142.5

0.38

0.06

0.99

Primary

AZ24373

54

Total

120.0

291.5

171.5

0.22

0.00

0.71

Enriched

120.0

264.0

144.0

0.23

0.00

0.75

Primary

264.0

291.5

27.5

0.13

0.00

0.53

AZ24374

52

Total

91.3

340.6

249.3

0.35

0.01

0.54

Enriched

91.3

340.6

249.3

0.35

0.01

0.54

Primary

AZ24375

45

Total

152.0

369.0

217.0

1.11

0.07

3.65

Enriched

152.0

369.0

217.0

1.11

0.07

3.65

Incl. 100 m of 1.32% Cu

Primary

AZ24376

4

Total

158.0

261.9

103.9

0.21

0.05

1.13

Enriched

158.0

193.0

35.0

0.28

0.02

0.69

Primary

193.0

261.9

68.9

0.18

0.06

1.35

AZ24377

9

Total

148.0

297.5

149.5

0.40

0.04

0.89

Enriched

148.0

291.4

143.4

0.41

0.04

0.88

Incl. 40 m of 0.62% Cu

Primary

291.4

297.5

6.2

0.20

0.04

0.92

AZ24378

29

Total

174.0

454.0

280.0

0.38

0.05

1.31

Enriched

174.0

314.0

140.0

0.41

0.05

1.19

Primary

314.0

454.0

140.0

0.34

0.06

1.43

AZ24379

24

Total

114.0

365.8

251.8

0.22

0.02

0.89

Enriched

114.0

365.8

251.8

0.22

0.02

0.89

Primary

AZ24380

5

Total

60.0

287.5

227.5

0.16

0.01

0.62

Enriched

60.0

256.0

196.0

0.17

0.01

0.63

Primary

256.0

287.5

31.5

0.12

0.00

0.58

AZ24381

18

Total

234.0

375.1

141.1

0.16

0.02

0.90

Enriched

234.0

292.0

58.0

0.22

0.02

0.90

Primary

292.0

375.1

83.1

0.12

0.02

0.90

AZ24382

20

Total

194.0

385.0

191.0

0.13

0.02

0.60

Enriched

194.0

329.0

135.0

0.15

0.02

0.70

Primary

329.0

385.0

56.0

0.10

0.01

0.37

AZ24383

50

Total

74.2

371.7

297.5

0.38

0.01

8.00

Enriched

74.2

356.0

281.8

0.39

0.01

8.39

Primary

356.0

371.7

15.7

0.18

0.01

0.86

AZ24384

18

Total

202.3

270.0

67.7

0.16

0.01

0.29

Enriched

202.3

270.0

67.7

0.16

0.01

0.29

Primary

AZ24385

38

Total

84.0

250.4

166.4

0.21

0.00

0.44

Enriched

84.0

216.0

132.0

0.21

0.00

0.46

Primary

216.0

250.4

34.4

0.19

0.01

0.33

AZ24386

1a

Total

228.0

380.3

152.3

0.21

0.06

1.07

Enriched

228.0

378.0

150.0

0.21

0.06

1.06

Primary

378.0

380.3

2.3

0.22

0.02

1.50

AZ24387

52

Total

62.0

452.0

390.0

0.46

0.07

2.27

Enriched

62.0

106.0

44.0

0.69

0.10

2.72

Incl. 44 m of 0.69% Cu

Primary

106.0

202.0

96.0

0.43

0.06

2.33

Incl. 132 m of 0.51% Cu

AZ24388

6

Total

170.0

245.3

75.3

0.21

0.10

1.22

Enriched

170.0

221.7

51.7

0.22

0.10

0.99

Primary

221.7

245.3

23.6

0.20

0.11

1.77

AZ24389

28

Total

176.0

343.3

167.3

0.16

0.01

0.52

Enriched

176.0

343.3

167.3

0.16

0.01

0.52

Primary

AZ24390

24

Total

194.0

338.8

144.8

0.15

0.01

0.38

Enriched

194.0

338.8

144.8

0.15

0.01

0.38

Primary

AZ24391

45

Total

133.0

331.0

198.0

0.84

0.09

2.32

Enriched

133.0

331.0

198.0

0.84

0.09

2.32

Incl. 129 m of 1.16% Cu

Primary

AZ24392A

54

Total

100.0

324.0

224.0

0.15

0.01

0.68

Enriched

100.0

306.0

206.0

0.16

0.01

0.71

Primary

306.0

324.0

18.0

0.13

0.00

0.27

AZ24393

16

Total

186.0

264.7

78.7

0.08

0.02

0.42

Enriched

186.0

264.7

78.7

0.08

0.02

0.42

Primary

AZ24394

28

Total

69.0

242.3

173.3

0.20

0.02

1.65

Enriched

69.0

144.0

75.0

0.14

0.01

0.46

Primary

144.0

242.3

98.3

0.24

0.03

2.55

AZ24395A

20

Total

168.0

407.0

239.0

0.16

0.01

0.45

Enriched

168.0

407.0

239.0

0.16

0.01

0.45

Primary

AZ24396

49

Total

81.0

497.0

416.0

0.37

0.13

2.40

Enriched

81.0

440.0

359.0

0.39

0.15

2.50

Primary

440.0

497.0

57.0

0.25

0.05

1.76

AZ24397

16

Total

198.0

412.4

214.4

0.25

0.05

1.11

Enriched

198.0

322.0

124.0

0.34

0.07

1.39

Primary

322.0

412.4

90.4

0.13

0.02

0.72

AZ24398

3a

Total

194.0

408.8

214.8

0.23

0.04

45.73

Enriched

194.0

408.8

214.8

0.23

0.04

45.73

Primary

AZ24399

16

Total

172.0

367.9

195.9

0.55

0.07

0.96

Enriched

172.0

367.9

195.9

0.55

0.07

0.96

Incl. 104 m of 0.65% Cu

Primary

AZ24400

26

Total

176.0

227.0

51.0

0.36

0.01

2.33

Enriched

176.0

227.0

51.0

0.36

0.01

2.33

Primary

AZ24401

32

Total

78.0

324.5

246.5

0.24

0.00

0.62

Enriched

78.0

324.5

246.5

0.24

0.00

0.62

Primary

AZ24402

20

Total

66.0

230.0

164.0

0.24

0.01

0.56

Enriched

66.0

166.0

100.0

0.29

0.01

0.64

Primary

166.0

230.0

64.0

0.17

0.01

0.44

AZ24403

43

Total

151.0

427.0

276.0

0.86

0.06

2.32

Enriched

151.0

427.0

276.0

0.86

0.06

2.32

Incl. 160.0 m of 0.96% Cu

Primary

AZ24404

29

Total

66.7

73.5

6.9

0.19

0.02

0.58

Enriched

66.7

72.0

5.4

0.18

0.01

0.25

Primary

72.0

73.5

1.5

0.23

0.04

1.80

AZ24404A

29

Total

87.0

133.0

46.0

0.14

0.01

2.18

Enriched

Primary

87.0

133.0

46.0

0.14

0.01

2.18

AZ24404B

29

Total

133.0

187.5

54.5

0.22

0.01

0.56

Enriched

Primary

133.0

187.5

54.5

0.22

0.01

0.56

AZ24405

14

Total

246.0

317.6

71.6

0.15

0.03

0.65

Enriched

246.0

314.0

68.0

0.15

0.03

0.65

Primary

314.0

317.6

3.6

0.16

0.02

0.61

AZ24406

55

Total

84.0

324.2

240.2

0.10

0.03

0.78

Enriched

84.0

230.0

146.0

0.14

0.02

0.79

Primary

230.0

324.2

94.2

0.05

0.04

0.77

AZ24407

12

Total

186.0

259.0

73.0

0.09

0.03

0.42

Enriched

186.0

259.0

73.0

0.09

0.03

0.42

Primary

AZ24408

32

Total

80.0

313.5

233.5

0.25

0.01

0.67

Enriched

80.0

313.5

233.5

0.25

0.01

0.67

Primary

AZ24409

54

Total

102.0

270.0

168.0

0.23

0.01

0.90

Enriched

102.0

270.0

168.0

0.23

0.01

0.90

Primary

AZ24410

6

Total

186.0

241.0

55.0

0.19

0.02

0.43

Enriched

186.0

241.0

55.0

0.19

0.02

0.43

Primary

AZ24411

14

Total

180.0

334.0

154.0

0.19

0.06

0.80

Enriched

180.0

232.0

52.0

0.31

0.08

0.70

Primary

232.0

334.0

102.0

0.13

0.05

0.86

AZ24412

12

Total

180.2

297.5

117.3

0.20

0.04

0.96

Enriched

180.2

272.0

91.8

0.22

0.04

0.99

Primary

272.0

297.5

25.5

0.13

0.04

0.85

AZ24413

38

Total

136.0

317.0

181.0

0.19

0.01

0.64

Enriched

136.0

317.0

181.0

0.19

0.01

0.64

Primary

AZ24414

47

Total

110.0

415.6

305.6

0.55

0.06

2.25

Enriched

110.0

415.6

305.6

0.55

0.06

2.25

Incl. 104.5 m of 0.73% Cu

Primary

AZ24415

56

Total

108.0

346.0

238.0

0.15

0.04

0.74

Enriched

108.0

322.0

214.0

0.15

0.04

0.74

Primary

322.0

346.0

24.0

0.12

0.05

0.73

AZ24417

12

Total

126.0

253.7

127.7

0.32

0.04

0.90

Enriched

126.0

253.7

127.7

0.32

0.04

0.90

Primary

AZ24418

16

Total

141.0

329.0

188.0

0.57

0.09

0.70

Enriched

141.0

284.0

143.0

0.63

0.09

0.77

Incl. 64 m of 0.66% Cu

Primary

284.0

329.0

45.0

0.41

0.11

0.48

Incl. 7 m of 0.58% Cu

AZ24419

6

Total

182.0

248.0

66.0

0.15

0.04

1.16

Enriched

182.0

204.0

22.0

0.27

0.03

0.77

Primary

204.0

248.0

44.0

0.09

0.05

1.35

AZ24421

44

Total

100.0

229.0

129.0

0.64

0.06

1.71

Enriched

100.0

229.0

129.0

0.64

0.06

1.71

Incl. 72 m of 0.85% Cu

Primary

AZ24422

42

Total

184.0

236.2

52.2

1.31

0.11

2.16

Enriched

184.0

236.2

52.2

1.31

0.11

2.16

Primary

GTK2424

15

Total

106.0

152.8

46.8

0.44

0.05

3.62

Enriched

106.0

152.8

46.8

0.44

0.05

3.62

Incl. 29.0 m of 0.60% Cu

Primary

GTK2424B

15

Total

152.8

272.9

120.2

0.69

0.03

1.30

Enriched

152.8

155.0

2.3

0.28

0.06

6.50

Primary

155.0

272.9

117.9

0.70

0.03

1.18

GTK2425

15

Total

150.0

300.0

150.0

0.21

0.05

1.00

Enriched

150.0

300.0

150.0

0.21

0.05

1.00

Primary

GTK2426

43

Total

70.0

400.0

330.0

0.62

0.09

1.99

Enriched

70.0

400.0

330.0

0.62

0.09

1.99

Incl. 150 m of 0.86% Cu

Primary

GTK2427

25

Total

160.0

250.0

90.0

0.14

0.00

0.37

Enriched

160.0

250.0

90.0

0.14

0.00

0.37

Primary

GTK2430

25

Total

121.5

125.0

3.5

0.08

0.00

0.25

Enriched

121.5

125.0

3.5

0.08

0.00

0.25

Primary

GTK2430A

25

Total

98.0

300.0

202.0

0.19

0.02

1.13

Enriched

98.0

300.0

202.0

0.19

0.02

1.13

Primary

GTK2431

49

Total

72.0

400.0

328.0

0.35

0.03

1.48

Enriched

72.0

400.0

328.0

0.35

0.03

1.48

Primary

GTK2432

8

Total

236.0

350.0

114.0

0.30

0.05

0.99

Enriched

236.0

350.0

114.0

0.30

0.05

0.99

Primary

OBS-MW-1

56

Total

42.0

519.0

477.0

0.08

0.04

0.50

Enriched

42.0

198.0

156.0

0.15

0.08

0.75

Primary

198.0

519.0

321.0

0.05

0.01

0.38

OBS-MW-2

45

Total

58.0

401.0

343.0

0.55

0.07

1.72

Enriched

58.0

401.0

343.0

0.55

0.07

1.72

Incl. 124 m of 0.80% Cu

Primary

OBS-MW-3

13

Total

196.0

332.0

136.0

0.55

0.06

1.28

Enriched

196.0

318.0

122.0

0.58

0.06

1.38

Incl. 116 m of 0.60% Cu

Primary

318.0

332.0

14.0

0.22

0.06

0.25

OBS-MW-3A

13

Total

331.5

542.0

210.5

0.28

0.03

0.53

Enriched

Primary

331.5

542.0

210.5

0.28

0.03

0.53

OBS-MW-4

43

Total

72.0

404.0

332.0

0.30

0.02

1.31

Enriched

72.0

228.0

156.0

0.34

0.03

1.60

Primary

228.0

404.0

176.0

0.26

0.01

1.06

Table 2 – Locations and Lengths of Recent Los Azules Drilling Results

HOLE-ID

Azimuth

Dip

Length

Loc X

Loc Y

Loc Z

AZ24316

250

-73

315.5

2383435.1

6558678.2

3666.7

AZ24317

70

-69

305.0

2383122

6560160.6

3674.5

AZ24318MET

90

-36

229.5

2382779.4

6559715.5

3599.8

AZ24319

70

-74

355.0

2383196.1

6559064.4

3662.8

AZ24320

270

-74

204.0

2383392.9

6558995.4

3643.8

AZ24321

250

-71

389.8

2383587.5

6558949.7

3658.1

AZ24322

250

-74

491.0

2383529.3

6559670.4

3678.8

AZ24323

250

-75

184.6

2382815.5

6558454.5

3745.7

AZ24324

70

-74

343.0

2383177

6559013.5

3655.6

AZ24325

70

-75

338.0

2383203

6558546.2

3674.4

AZ24326

70

-75

331.0

2383435

6558675.4

3666.9

AZ24327

250

-73

316.0

2383306.1

6558900.8

3659

AZ24328

68

-78

231.0

2383354.5

6559819.4

3629.4

AZ24329

250

-76

332.0

2383267.6

6558804.7

3662.4

AZ24330

263

-70

185.0

2383121.7

6560157.4

3674.5

AZ24332

70

-70

255.6

2383385.1

6558761.7

3663.1

AZ24333

301

-52

194.8

2383371.7

6559955.7

3634.3

AZ24334

250

-80

657.0

2383092.1

6559726.7

3614.6

AZ24335

70

-78

227.5

2383420.4

6558945.8

3646

AZ24336CC

250

-75

501.0

2383790.1

6557046.2

3823

AZ24338

250

-70

729.5

2384000

6557297.5

3883.3

AZ24339CC

250

-75

517.5

2383757.2

6556832.1

3814.6

AZ24340

70

-75

300.5

2383315.6

6558678

3668.4

AZ24341

250

-70

261.5

2383352

6559818.5

3629.4

AZ24342

70

-77

235.5

2383292.3

6558738.8

3661.9

AZ24343

185

-66

365.6

2382578.4

6560067

3586.9

AZ24344

250

-72

312.0

2383467.1

6559604.4

3666.3

AZ24345

250

-71

291.2

2382849.6

6559429.1

3630

AZ24346

249

-67

196.6

2382734.1

6559174.8

3658.4

AZ24347

250

-75

295.8

2383765.6

6558161.7

3713.7

AZ24348

70

-76

373.7

2383529.3

6559460.5

3689.2

AZ24349

250

-71

356.0

2383437.7

6558468.5

3700.7

AZ24350

243

-68

224.0

2382747.6

6558657.2

3744.2

AZ24351A

70

-73

449.4

2383570.2

6558891.6

3657

AZ24352

250

-76

379.3

2383637.7

6558013.6

3763

AZ24353

250

-71

338.5

2382747.2

6559491.2

3634.9

AZ24354

70

-72

331.0

2383492

6559556

3675.8

AZ24355

198

-69

288.5

2382702.8

6560022.5

3591

AZ24356

119

-63

205.5

2383473.6

6560288.5

3635.9

AZ24357

250

-74

386.0

2383719.2

6558572.6

3692.8

AZ24358

250

-74

264.5

2382963.9

6559038.7

3656.4

AZ24360

242

-81

335.5

2383323.4

6558544.4

3672.3

AZ24361

70

-67

335.2

2383633.7

6558012.4

3762.8

AZ24362

70

-77

309.0

2382967.6

6558938

3658

AZ24363

250

-68

335.6

2382600.9

6559549.9

3631.6

AZ24364

305

-63

215.4

2383473.5

6560004.4

3632.3

AZ24365

209

-65

291.5

2382823.8

6559998.4

3596.3

AZ24366

70

-74

328.2

2383719.2

6558572.5

3692.9

AZ24367

150

-70

433.5

2383369.4

6559934.6

3632.3

AZ24368

70

-70

220.5

2383843.8

6557666.9

3759.5

AZ24369A

15

-35

248.0

2382815.2

6559609.1

3611.2

AZ24370

70

-73

290.0

2383762.9

6557847.5

3751

AZ24371

70

-80

302.1

2382963.7

6559039.3

3656.6

AZ24372

70

-72

298.2

2383721.7

6557926.1

3743.3

AZ24373

70

-75

291.5

2382487.8

6559839.3

3587.8

AZ24374

70

-80

340.6

2382378.8

6559677.2

3595.8

AZ24375

280

-40

369.0

2383234.7

6559609

3618

AZ24376

250

-76

261.9

2383854.5

6557668

3759.8

AZ24377

250

-70

297.5

2383912.7

6557951.5

3733.8

AZ24378

249

-84

454.0

2383572.8

6558894.3

3656.9

AZ24379

250

-79

365.8

2383672.9

6558661.5

3671.5

AZ24380

250

-69

287.5

2383520.9

6557574.7

3754.9

AZ24381

250

-73

375.1

2383881.6

6558410.5

3744.4

AZ24382

250

-75

385.0

2383812.9

6558493.9

3722.1

AZ24383

250

-75

371.7

2382534.8

6559631

3619.9

AZ24384

70

-72

270.0

2383876

6558413.8

3744

AZ24385

250

-74

250.4

2382677.9

6559044.2

3699.1

AZ24386

70

-66

380.3

2383594.5

6557354.9

3770

AZ24387

160

-75

452.0

2383073.9

6559955.7

3615.8

AZ24388

250

-73

245.3

2383809

6557753.3

3759.2

AZ24389

70

-75

343.3

2383652.7

6558870.2

3668.6

AZ24390

70

-67

338.8

2383672.7

6558661.5

3671.8

AZ24391

218

-37

331.0

2383237.1

6559607.8

3618

AZ24392A

250

-71

324.0

2382488.6

6559841.7

3587.7

AZ24393

70

-74

264.7

2383915.7

6558318.9

3763.5

AZ24394

250

-71

242.3

2383003.5

6558630.9

3681.5

AZ24395A

70

-72

407.0

2383810.6

6558491.4

3722.2

AZ24396

70

-70

497.0

2382951.1

6559736.8

3610.2

AZ24397

250

-73

412.4

2383914.1

6558320

3763.5

AZ24398

250

-75

408.8

2383875.3

6557352.8

3819.4

AZ24399

250

-71

367.9

2383549.7

6558195.1

3737.3

AZ24400

70

-80

227.0

2383849.2

6558833.7

3730

AZ24401

70

-71

324.5

2382979.8

6558834.9

3659.8

AZ24402

70

-79

230.0

2383224.9

6558285.7

3695.7

AZ24403

288

-38

427.0

2383241

6559501

3622.5

AZ24404

70

-80

73.5

2382979.1

6558675.9

3676.6

AZ24404A

70

-80

133.0

2382976.8

6558675.1

3676.4

AZ24404B

70

-80

187.5

2382979.2

6558676.2

3676.5

AZ24405

70

-70

317.6

2383898.7

6558212.1

3758.5

AZ24406

5

-73

324.2

2382428.7

6559844.6

3584.9

AZ24407

70

-75

259.0

2383947.8

6558123.8

3772.9

AZ24408

250

-73

313.5

2383123.5

6558887.3

3652.9

AZ24409

70

-71

270.0

2383325.1

6560123.8

3637

AZ24410

70

-74

241.0

2383810.2

6557751.3

3759.3

AZ24411

250

-75

334.0

2383900.6

6558211.4

3758.5

AZ24412

250

-77

297.5

2383951.4

6558124.2

3773.1

AZ24413

70

-71

317.0

2383520.4

6559350.7

3679.3

AZ24414

270

-48

415.6

2383225.1

6559738

3619.7

AZ24415

70

-70

346.0

2383245

6560206.7

3679.7

AZ24416

250

-75

201.0

2380165.6

6563489.6

3660.7

AZ24417

250

-67

253.7

2383846.3

6558100

3721.4

AZ24418

70

-77

329.0

2383458.5

6558159

3714.9

AZ24419

70

-73

248.0

2383934.6

6557799

3756.1

AZ24420

70

-72

130.2

2383908.7

6557896.2

3737

AZ24421

259

-62

229.0

2383234.5

6559560.4

3621.3

AZ24422

250

-35

236.2

2383244

6559487.3

3620.8

GTK2424

240

-60

152.8

2383264.4

6558036.3

3715.5

GTK2424B

240

-60

272.9

2383267

6558032.5

3715.7

GTK2425

60

-60

300.0

2383748.7

6558200.4

3706.7

GTK2426

60

-70

400.0

2383250.9

6559528.2

3623.5

GTK2427

60

-65

250.0

2383595.5

6558686.7

3667

GTK2428

0

-90

100.2

2383357.8

6558607.9

3682.7

GTK2429

0

-90

100.0

2383198.9

6559061.2

3662.6

GTK2430

240

-65

125.0

2383142.9

6558538.2

3676.3

GTK2430A

240

-65

300.0

2383142.1

6558540.1

3676.3

GTK2431

340

-65

400.0

2382804.6

6559687.8

3607.7

GTK2432

170

-65

350.0

2383672.8

6557811.5

3784.3

OBS-MW-1

0

-90

519

2383457.9

6560277.3

3636.7

OBS-MW-2

0

-90

401

2383284.9

6559630

3627.1

OBS-MW-3

0

-90

332

2383569.5

6558052.6

3777

OBS-MW-3A

0

-90

542

2383570.4

6558052.5

3776.8

OBS-MW-4

0

-90

404

2382888.5

6559379

3633.9

Coordinates listed in Table 2 based on Gauss Kruger – POSGAR 94 Zone 2

The McEwen Mining press release appears to be reviewed and verified by a Qualified Person (as that term is defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects) and the procedures, methodology and key assumptions disclosed therein are those adopted and consistently applied in the mining industry, but no Qualified Person engaged by TNR has done sufficient work to analyze, interpret, classify or verify McEwen Mining’s information to determine the current mineral resource or other information referred to in its press releases. Accordingly, the reader is cautioned in placing any reliance on the disclosures therein.

“We are pleased that significant developments on the advancement of the Los Azules Copper Project towards feasibility have led to the increased Stellantis holdings in McEwen Copper as a strategic partner of this large copper, gold and silver project. In February 2023, Stellantis invested ARS $30 billion, and with an additional investment of ARS $42 billion made after the new preliminary economic assessment (PEA) publication, has a total investment of ARS $72 billion. An aggregate of US $65 million in McEwen Copper was also invested by Rio Tinto’s Venture Nuton in 2022 and 2023,” stated Kirill Klip, TNR’s Chief Executive Officer. “TNR Gold’s vision is aligned with the leaders of innovation among automakers like Stellantis, whose aim is decarbonizing mobility, and mining industry leaders such as Rob McEwen, whose vision is ‘to build a mine for the future, based on regenerative principles that can achieve net zero carbon emissions by 2038’.

“The green energy rEVolution relies on the supply of critical metals like copper; delivering “green copper” to Argentina and the world will contribute to the clean energy transition and electrification of transportation and energy industries.

“The new president of Argentina introduced important government policies aimed at supporting business and unlocking the country’s economic potential. Mining is being recognized as an integral part of this economic development plan, providing jobs and enriching local communities.

“Strong team performance of McEwen Copper is advancing the Los Azules Project towards a feasibility study. The Los Azules Project PEA results highlight the potential to create a robust leach project while reducing the environmental footprint, and greater environmental and social stewardship sets the Project apart from other potential mine developments.

“It’s also encouraging to see an updated independent mineral resource estimate that has increased the resource significantly. Infill drilling during the 2023-24 season upgraded the resource categories, validated the geological model and confirmed the high-grade zone. Resource drilling for the Los Azules Feasibility Study is now complete, and the study appears to be on track for delivery in early 2025.

“Together with Nuton, McEwen Copper is exploring new technologies that save energy, water, time and capital, advancing Los Azules towards the goal of leading environmental performance. The involvement of Rio Tinto, with its innovative technology, may also accelerate realizing the enormous potential of the Los Azules Project.

“Los Azules was ranked in the top ten largest undeveloped copper deposits in the world by Mining Intelligence (2022). TNR Gold does not have to contribute any capital for the development of the Los Azules Project. The essence of our business model is to have industry leaders like McEwen Mining as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.”

ABOUT TNR GOLD CORP.

TNR Gold Corp. is working to become the green energy metals royalty and gold company.

Our business model provides a unique entry point in the creation of supply chains for critical materials like energy metals that are powering the energy rEVolution, and the gold industry that is providing a hedge for this stage of the economic cycle.

Our portfolio provides a unique combination of assets with exposure to multiple aspects of the mining cycle: the power of blue-sky discovery and important partnerships with industry leaders as operators on the projects that have the potential to generate royalty cashflows that will contribute significant value for our shareholders.

Over the past twenty-eight years, TNR, through its lead generator business model, has been successful in generating high-quality global exploration projects. With the Company’s expertise, resources and industry network, the potential of the Mariana Lithium Project and Los Azules Copper Project in Argentina among many others have been recognized.

TNR holds a 1.5% NSR Royalty on the Mariana Lithium Project in Argentina, of which 0.15% NSR royalty is held on behalf of a shareholder. Ganfeng Lithium’s subsidiary, Litio Minera Argentina (“LMA“), has the right to repurchase 1.0% of the NSR royalty on the Mariana Project, of which 0.9% is the Company’s NSR Royalty interest. The Company would receive CAN$900,000 and its shareholder would receive CAN$100,000 on the repurchase by LMA, resulting in TNR holding a 0.45% NSR royalty and its shareholder holding a 0.05% NSR royalty.

The Mariana Lithium Project is 100% owned by Ganfeng Lithium. The Mariana Lithium Project has been approved by the Argentina provincial government of Salta for an environmental impact report, and the construction of a 20,000 tons-per-annum lithium chloride plant has commenced.

TNR Gold also holds a 0.4% NSR Royalty on the Los Azules Copper Project, of which 0.04% of the 0.4% NSR royalty is held on behalf of a shareholder. The Los Azules Copper Project is being developed by McEwen Mining.

TNR also holds a 7% net profits royalty holding on the Batidero I and II properties of the Josemaria Project that is being developed by Lundin Mining. Lundin Mining is part of the Lundin Group, a portfolio of companies producing a variety of commodities in several countries worldwide.

TNR provides significant exposure to gold through its 90% holding in the Shotgun Gold porphyry project in Alaska. The project is located in Southwestern Alaska near the Donlin Gold project, which is being developed by Barrick Gold and Novagold Resources. The Company’s strategy with the Shotgun Gold Project is to attract a joint venture partnership with a major gold mining company. The Company is actively introducing the project to interested parties.

At its core, TNR provides a wide scope of exposure to gold, copper, silver and lithium through its holdings in Alaska (the Shotgun Gold porphyry project) and royalty holdings in Argentina (the Mariana Lithium project, the Los Azules Copper Project and the Batidero I & II properties of the Josemaria Project), and is committed to the continued generation of in-demand projects, while diversifying its markets and building shareholder value.

On behalf of the Board of Directors,

Kirill Klip

Executive Chairman

www.tnrgoldcorp.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

Except for statements of historical fact, this news release contains certain “forward-looking information” within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate”, “will”, “could” and other similar words, or statements that certain events or conditions “may” or “could” occur, although not all forward-looking statements contain these identifying words. Specifically, forward-looking statements in this news release include, but are not limited to, statements made in relation to: TNR’s corporate objectives, and future potential transactions being considered by the Special Committee and the Board. Such forward-looking information is based on a number of assumptions and subject to a variety of risks and uncertainties, including but not limited to those discussed in the sections entitled “Risks” and “Forward-Looking Statements” in the Company’s interim and annual Management’s Discussion and Analysis which are available under the Company’s SEDAR+ profile on www.sedarplus.ca. While management believes that the assumptions made and reflected in this news release are reasonable, should one or more of the risks, uncertainties or other factors materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking information. In particular, there can be no assurance that: TNR will enter into one or more strategic transactions, partnership or a spin-out, or be able to complete any further royalty acquisitions or sales of royalty interests, or portions thereof; debt or equity financings will be available to TNR; or that TNR will be able to achieve any of its corporate objectives. TNR relies on the confirmation of its ownership for mining claims from the appropriate government agencies when paying rental payments for such mining claims requested by these agencies. There could be a risk in the future of the changing internal policies of such government agencies or risk related to the third parties, in future, challenging the ownership of such mining claims. Given these uncertainties, readers are cautioned that forward-looking statements included herein are not guarantees of future performance, and such forward-looking statements should not be unduly relied on.

In formulating the forward-looking statements contained herein, management has assumed that business and economic conditions affecting TNR and its royalty partners, McEwen Mining Inc., Ganfeng Lithium and Lundin Mining will continue substantially in the ordinary course, including without limitation with respect to general industry conditions, general levels of economic activity and regulations. These assumptions, although considered reasonable by management at the time of preparation, may prove to be incorrect.

Forward-looking information herein and all subsequent written and oral forward-looking information are based on estimates and opinions of management on the dates they are made and are expressly qualified in their entirety by this cautionary statement. Except as required by law, the Company assumes no obligation to update forward-looking information should circumstances or management’s estimates or opinions change.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/219860

SOURCE: TNR Gold Corp.

The post TNR Gold NSR Royalty Update – Los Azules Copper, Gold and Silver Project: Los Azules Infill Drilling Confirmed High-Grade Copper Zone appeared first on Invezz