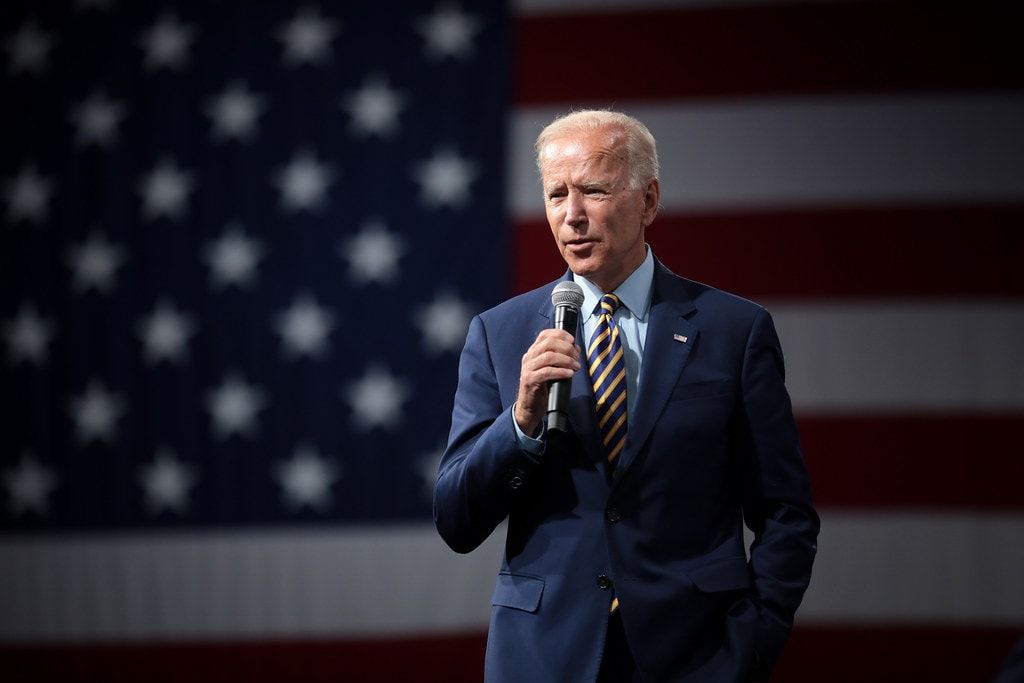

In a final push before leaving office, President Joe Biden’s administration has announced a ban on including medical debt in American consumers’ credit reports.

This new regulation, adopted despite objections from the banking and consumer data industries, fulfills a campaign year pledge and is aimed at alleviating the financial burden on millions of Americans.

The move comes just weeks before President-elect Donald Trump is set to take office, raising questions about the policy’s long-term stability.

$49 billion in debt erased from credit reports

Officials estimate that this new regulation will remove $49 billion in medical bills from the credit reports of approximately 15 million Americans.

The US Consumer Financial Protection Bureau (CFPB) said the change would provide much-needed relief to those struggling with medical debt, and would help more people access affordable loans.

This action, taken despite demands from Congressional Republicans to halt new rules, underscores the Biden administration’s commitment to protecting consumers and improving their financial well-being.

“Life-Changing” policy, says Vice President Harris

Vice President Kamala Harris, who initially championed the policy proposal in June, described the move as “life-changing for millions of families.”

In a statement, Harris emphasized that “No one should be denied economic opportunity because they got sick or experienced a medical emergency,” highlighting the unfairness of allowing medical debt to impact creditworthiness.

Improved lending access and consumer protection

The CFPB contends that medical debt is a poor indicator of a borrower’s likelihood of repaying a loan.

The agency believes this change should lead to an increase of 22,000 low-cost mortgages per year, along with improvements in consumer credit scores.

Additionally, the new rule will prohibit lenders from using medical information when making lending decisions, and it aims to protect consumers from being coerced into paying medical debts they don’t actually owe.

The American Medical Association has endorsed this change, citing its positive impact on patient finances.

Banking and credit industries voice concerns

However, trade groups representing banks and credit bureaus have voiced strong opposition to the new rule, stating that the evidence doesn’t justify the CFPB’s decision.

They warn that the ban could deprive financial institutions of crucial information regarding borrower risk, potentially leading to fewer loans being offered.

The American Bankers Association has specifically expressed concern that this ban could negatively impact lenders’ willingness to offer credit.

The post Biden admin to remove $49B in medical debt from credit reports, impacting 15M Americans appeared first on Invezz