October 01, 2024 7:40 PM EDT | Source: Golden Horse Minerals Limited

Highlights:

Golden Horse has entered a conditional Sale Agreement (“Sale Agreement”) with Torque Metals to acquire 100% of its Bullfinch Gold Project.

The Sale Agreement provides Golden Horse an additional 422km2 of tenure adjacent to the Company’s existing tenements in the Southern Cross Greenstone Belt.

The area has numerous historical small gold mines throughout the Sale Agreement area including Withers Gold Mine which has recorded production grades of up to 35.7 g/t gold.

Terms of the transaction include:

A$250,000 cash payment upon transfer of the tenure; and

A$200,000 milestone cash payment upon the delineation of a 100,000oz JORC resource of contained gold.

Perth, Australia–(Newsfile Corp. – October 1, 2024) – Golden Horse Minerals Limited, (TSXV: GHML) (“Golden Horse” or the “Company“) is pleased to announce the Company has entered into a sale agreement dated September 25, 2024 (the “Sale Agreement“) to acquire tenements within Torque Metals’ Bullfinch Gold Project (“Bullfinch“), located 34km from the Southern Cross township within the Yilgarn Mineral Field, Western Australia and adjacent to Golden Horse’s existing tenements.

The Sale Agreement is a new agreement based on new transaction terms compared to the previously announced sale agreement between Golden Horse (under its previous name, Altan Rio Minerals Limited) and Torque Metals regarding the Bullfinch Project in June 20231, which was subsequently terminated in May 20242.

The Bullfinch tenement area covers 422km2 over six exploration licences and has recorded historical production grades of 35.7 g/t gold at the Withers prospect. The project is in the Southern Cross Greenstone Belt which has recorded production of over 12 million ounces of gold3.

Golden Horse’s Managing Director & CEO Nicholas Anderson commented:

“We are excited to enter into the Sale Agreement with Torque Metals, which will significantly expand our footprint in the highly prospective Yilgarn Mineral Field. The acquisition of the Bullfinch Gold Project will add 422km² of tenure adjacent to our existing holdings and enhances our exploration potential as it includes the high-grade Withers prospect which has recorded grades of 35.7 g/t gold.

We look forward to leveraging our expertise and the existing geological data to advance exploration at Bullfinch, with the goal of unlocking its full potential. This acquisition strengthens Golden Horse’s presence in the Yilgarn Mineral Field, and we are eager to commence further exploration to build on the promising results already identified.”

Bullfinch Overview

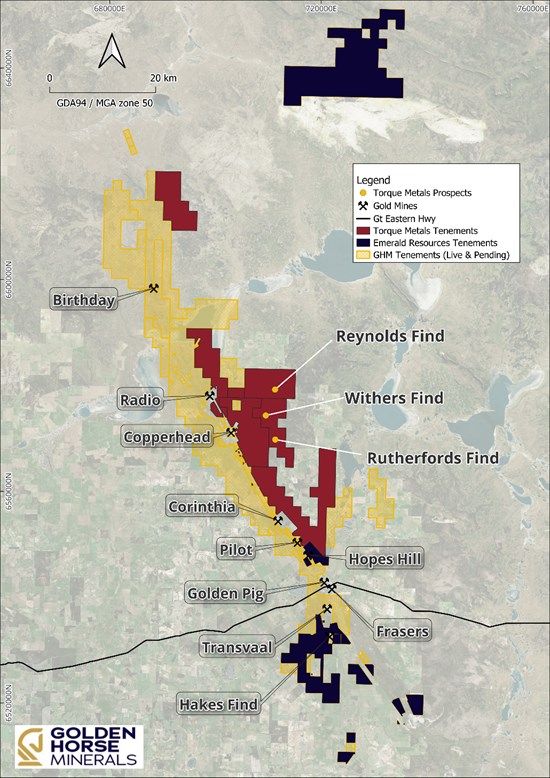

The Bullfinch project (see Figure 1) is located on Archaean greenstone lithologies prospective for gold deposits, massive sulphide nickel-copper deposits, iron ore and lithium. Three historic workings – Withers, Reynolds Find and Rutherford Find – are the most advanced exploration prospects on the tenure and all warrant follow up exploration4 .

Figure 1: Location of Golden Horse tenements and Bullfinch tenement area in the Southern Cross Greenstone Belt.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8288/225324_cb760fdef452eb11_001full.jpg

Withers

The Withers prospect, which lies 6km WNW of the historic Copperhead mine site, consists of over three kilometres of historical workings and has recorded past production of 1,472 tonnes of ore at a recovered grade of 35.7 g/t (1,688 ounces).

Results from grab-sampling undertaken by Torque Metals suggested probable high-grade gold structures in some of the already identified geophysical anomalies. These gold results indicate significant potential for additional gold discoveries. Significant results of the grab-sampling are as follows with locations shown in Figure 2:

(TMGS10001) – grab sample (Old workings) 16 g/t Au;

(TMGS10011) – grab sample (Old workings) 2.05 g/t Au; and

(TMGS10016) – grab sample (Mafic sequence outcrop) 9.79 g/t Au.

Figure 2: Grab sample location at Withers.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8288/225324_cb760fdef452eb11_002full.jpg

Rutherfords Find

The Rutherfords Find prospect has had limited exploration with only twelve historic reverse circulation (“RC“) holes drilled to date (see Figure 3). However, these drill holes produced 10 significant gold intersections with two holes hitting wide zones:

8m @ 5.4 g/t Au, including 4m @ 10.1 g/t Au, and open at depth (BRC30); and

8m @ 3.9 g/t Au, including 2m @ 9 g/t Au, (BRC19).

There has been no follow-up drilling of these holes. Historical production was also carried out at Rutherfords Find of 194 ounces of gold from 308 tonnes at an average recovered grade of 19.6 g/t Au.

Figure 3: Historical drill intersections at Rutherford’s Find

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8288/225324_cb760fdef452eb11_003full.jpg

Reynolds Find

The Reynolds Find prospect has been explored by several previous title holders. The best intercepts were encountered in 3 of the 4 holes drilled on a section immediately east of the historical workings. Results are provided below and in Figure 4:

Figure 4: Cross-section of RC drill holes at Reynolds Find.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8288/225324_cb760fdef452eb11_004full.jpg

Transaction

The material terms of the Sale Agreement are as follows:

Golden Horse to make a A$250,000 cash payment to Torque Metals upon transfer of the tenure expected to occur in September 2024;

Golden Horse to make a milestone A$200,000 cash payment to Torque Metals upon the delineation of a JORC resource of at least 100,000 ounces of contained gold.

For and on behalf of the Board

Nicholas Anderson

Managing Director & CEO

For more information contact:

Mr Travis Vernon, a member of the Australian Institute of Mining and Metallurgy (AusIMM) and an independent Qualified Person as defined by National Instrument 43-101, is responsible for the preparation of the technical content regarding the Southern Cross Project contained in this document. Mr. Vernon is the Geology Manager for Golden Horse Minerals and has reviewed and approved the technical disclosure in this news release.

Disclaimer

This release may include forward-looking statements. Such forward-looking statements may include, among other things, statements regarding targets, estimates and assumptions in respect of metal production and prices, operating costs and results, capital expenditures, mineral reserves and mineral resources and anticipated grades and recovery rates, and are or may be based on assumptions and estimates related to future technical, economic, market, political, social and other conditions. These forward-looking statements are based on management’s expectations and beliefs concerning future events. Forward-looking statements inherently involve subjective judgement and analysis and are necessarily subject to risks, uncertainties and other factors, many of which are outside the control of Golden Horse. Such forward‐looking statements are based on numerous assumptions regarding the Golden Horse’s present and future business strategies and the political and economic environment in which the Golden Horse will operate in the future, which are not guarantees or predictions of future performance. Actual results and developments may vary materially from those that may be contemplated or implied by forward-looking statements in this release.

Given these uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. All information in respect of Exploration Results and other technical information should be read in conjunction with Competent Person Statements in this release (where applicable). To the maximum extent permitted by law, Golden Horse and any of its related bodies corporate and affiliates and their officers, employees, agents, associates and advisers:

disclaim any obligations or undertaking to release any updates or revisions to the information in this release to reflect any events, circumstances or change in expectations or assumptions after the date of this release;

do not make any representation or warranty, express or implied, as to the accuracy, reliability or completeness of the information in this release, or likelihood of fulfilment of any forward-looking statement or any event or results expressed or implied in any forward-looking statement; and

disclaim all responsibility and liability for these forward-looking statements (including, without limitation, liability for negligence).

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

1 Refer to the Company’s announcement dated June 26, 2023.

2 Refer to the Company’s announcement dated May 16, 2024.

3 Refer to Torque announcement dated January 31, 2022.

4 Refer to the Company’s announcement dated September 03, 2024

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/225324

SOURCE: Golden Horse Minerals Limited

The post Golden Horse Continues to Expand Southern Cross Footprint with Bullfinch Acquisition appeared first on Invezz