NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR DISSEMINATION IN THE UNITED STATES. ANY FAILURE TO COMPLY WITH THIS RESTRICTION MAY CONSTITUTE A VIOLATION OF U.S. SECURITIES LAW.

CALGARY, Alberta, Sept. 12, 2024 (GLOBE NEWSWIRE) — Logan Energy Corp. (TSXV: LGN) (“Logan” or the “Company“) is pleased to announce the details of its Duvernay land position, which represents a new play type comprised of highly economic drilling inventory, and the acceleration of full field development at Pouce Coupe, including the construction of a 40 mmcf/d gas plant and associated infrastructure. In addition, the Company is pleased to announce its expanded 2024 budget and a fully funded preliminary budget for 2025, which will deliver 82% growth in Adjusted Funds Flow per share.

Logan is also pleased to announce an equity financing to be offered on a bought deal, private placement basis, with National Bank Financial Inc. as sole bookrunner and co-lead underwriter and Eight Capital as co-lead underwriter, for aggregate gross proceeds of $30.0 million (the “Equity Offering“).

In connection with the accelerated capital expenditure budget and construction of the Pouce Coupe infrastructure, Logan has also received a commitment letter from National Bank of Canada (the “Lender“) pursuant to which the Lender has agreed to provide the Company with new committed credit facilities in the aggregate principal amount of $125.0 million (the “New Credit Facilities“).

DUVERNAY POSITION

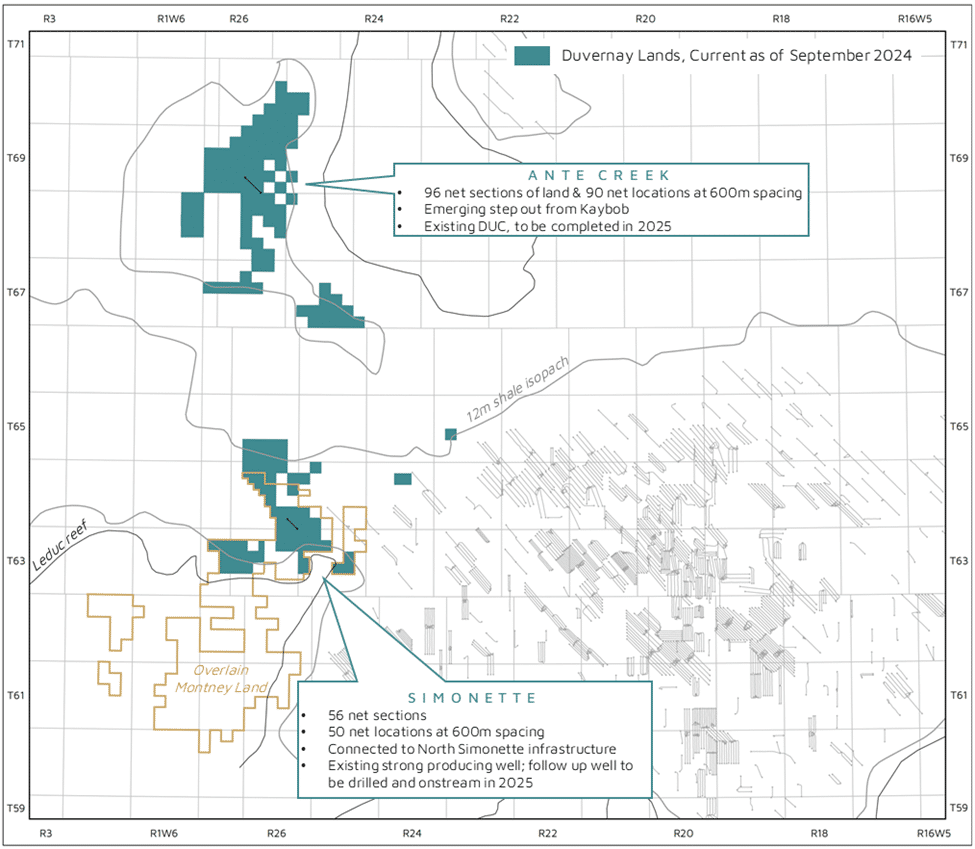

Logan has assembled a ~152 section position within the greater Kaybob Duvernay oil play. Logan’s position is comprised of blocks located in North Simonette (the “Simonette Duvernay“) and Ante Creek (the “Ante Creek Duvernay“, and collectively, the “Duvernay Assets“). Underpinned by thorough geotechnical evaluation, the Duvernay Assets add over 140 extended reach horizontal Duvernay oil locations1. The Duvernay Assets provide incremental development opportunities to complement Logan’s organic development plans for its existing Pouce Coupe and Simonette Montney assets. The Company believes growth to 20,000 to 25,000 BOE/d by 2028 will be achievable from the development of its existing Montney assets alone. Logan plans to continually rationalize and expand its Duvernay position over this period.

Simonette Duvernay

The Simonette Duvernay asset is comprised of ~56 net sections with 50 net locations1.

Development of these lands will utilize existing Logan infrastructure and will benefit from co-development of the Company’s North Simonette Montney assets.

The Simonette Duvernay lands are largely delineated with previous drilling and offer highly economic oil inventory. A 1,568 meter horizontal Duvernay well (13-01-064-26W5) completed in 2015 on Logan lands will yield an expected oil EUR of over 210 mbbl of oil; normalizing this to a 3,500 meter horizontal would yield an expected oil EUR of over 468 mbbl.

Within the 2025 budget, Logan plans to drill and place onstream one net Simonette Duvernay well to demonstrate the asset productivity with a modern full length well.

________________________

1 Assuming a conservative 600 meter inter well spacing, average length of ~3,500 meter horizontal. See “Reader Advisories – Drilling Locations“.

Ante Creek Duvernay

The Ante Creek Duvernay asset is comprised of ~96 net sections with over 90 net locations1.

The Ante Creek Duvernay land base is a northern extension of the Kaybob Duvernay trend. Logan believes the Ante Creek Duvernay will deliver similar results as Simonette and other areas in Kaybob of similar thickness.

Logan believes the Sturgeon Creek area Duvernay wells in TWP70-22 to be the low case for the Ante Creek Duvernay, which has higher pressures (>45 MPa), less carbonate material and better fluid properties (more gas drive) than the Sturgeon area.

Logan drilled an initial Ante Creek Duvernay well in the second quarter of 2024 that will be completed and put on production as part of the 2025 program.

Logan Duvernay Lands

ACCELERATED POUCE COUPE DEVELOPMENT

With the funding announced herein, Logan is pleased to announce the accelerated full field development of its Pouce Coupe assets, including the construction of a 40 mmcf/d gas plant, compressor station and oil battery. This infrastructure will enable the asset to grow from its current constraint of ~3,500 BOE/d to ~10,000 BOE/d.

Logan is budgeting approximately $32 million for the gas plant, battery and compression (inclusive of $10 million of 2024 long lead capital). Incremental to the facility capital, Logan is budgeting approximately $15 million for gathering and sales pipelines in 2025 but will look to partner with third parties to jointly own and develop certain sales pipelines where beneficial to reduce capital costs. The facility is expected to be commissioned by mid-2025, with eight new wells to be brought onstream concurrently. The facility will be designed to handle 40 mmcf/d of gas, 7,000 bbl/d of oil and 11,000 bbl/d of water and the asset NGL yield will increase to ~17 bbl/mmcf from ~10 bbl/mmcf presently.

The decision for Logan to build an owned fit-for-purpose facility was compelling because of Logan’s highly competitive cost structure driven by in-house engineering and an entrepreneurial approach to procurement. The compression and battery portion of the facility would have been required whether gas was to be processed via third party or a new Logan owned plant. The payout on the incremental capital to expand the battery to also being a gas plant will be under fifteen months. This facility is a key element in Logan’s plan to reduce its corporate operating cost to below $8.00 per BOE by 2028 and will enable Logan to accelerate drilling in Pouce Coupe which is the Company’s highest liquid weighted drilling inventory.

Accelerating this development initially planned for 2026 was enabled by the availability of gas egress, which allows Logan to deliver on its five year growth plan more quickly. By the fourth quarter of 2025, Logan expects its Pouce Coupe asset to be producing over 7,300 BOE/d through owned infrastructure and over a decade of tier one oil weighted inventory remaining.

EQUITY OFFERING

Logan has entered into an agreement with a syndicate of underwriters (the “Underwriters“) with National Bank Financial Inc. as sole bookrunner and co-lead underwriter and Eight Capital as co-lead underwriter (the “Lead Underwriters“), pursuant to which the Underwriters have agreed to purchase for resale on a private placement, bought deal basis, 41,096,000 common shares (“Common Shares“) at a price of $0.73 per Common Share for aggregate gross proceeds of approximately $30.0 million. Certain directors, officers and employees of the Company will subscribe for approximately $5.0 million of the Equity Offering.

Logan intends to use the net proceeds from the Equity Offering to fund a portion of its accelerated development program in the Montney and Duvernay and for general corporate purposes. Timed with the construction of the Pouce Coupe facility, the Company believes the incremental value it can create with the proceeds of the Equity Offering more than offsets the small amount of dilution resulting from the Equity Offering and positions the Company well for accelerated future growth.

The completion of the Equity Offering is subject to customary closing conditions, including the receipt of all necessary regulatory approvals, including the approval of the TSX Venture Exchange (“TSXV“). Closing of the Equity Offering is expected to occur on or around October 3, 2024. The Company has agreed to pay a cash commission of 4.0% of the gross proceeds of the Equity Offering to the Underwriters, except with respect to subscribers to be included on the president’s list for which no commission will be paid.

The Common Shares will be subject to a statutory hold period that extends four months from the Closing Date; provided that any Common Shares issued in the United States will be subject to a 1 year hold period, subject to the ability to resell the Common Shares on the TSXV prior to 1 year in accordance with U.S. securities laws.

NEW CREDIT FACILITIES

In connection with the accelerated capital expenditure budget and construction of the Pouce Coupe infrastructure, the Company has received a commitment letter from the Lender, pursuant to which the Lender has agreed to commit, on a bilateral basis, to provide the Company with the New Credit Facilities in the aggregate principal amount of $125.0 million. The New Credit Facilities are comprised of a $50.0 million delayed draw term facility with a maximum initial tenor of up to 2.5 years from closing (the “Term Facility“), and a $75.0 million senior secured revolving committed term credit facility with an initial tenor of 2.0 years from closing (the “Revolving Credit Facility“), which will, in aggregate, replace the Company’s existing $75.0 million demand credit facility upon closing.

Closing of the New Credit Facilities is expected to occur on or around October 3, 2024 and is subject to closing of the Equity Offering and other customary conditions.

The Term Facility and the Revolving Credit Facility will each be secured by all of the assets of the Company, bear interest at market rates that fluctuate plus a margin based on the net debt to EBITDA ratio of the Company and include customary debt covenants for lending arrangements of this nature.

The Term Facility is available to draw after January 1, 2025 and prior to May 31, 2025, to a maximum principal amount of up to $50.0 million and will be used to fund the Company’s Pouce Coupe infrastructure and accelerated development in the area. The Term Facility matures at the earlier of 2.5 years from closing and 2.0 years from the date of the initial draw and is prepayable anytime without penalty. Repayments of principal are not required until the maturity date, provided the Company is in compliance with all covenants, representations and warranties.

REVISED 2024 GUIDANCE

The 2024 capital budget is being expanded from $120 million to $140 million. The increase is predominantly for certain long lead projects connected to the Pouce Coupe facility and to accelerate two drills in Simonette into 2024, which will enable the pad to be onstream before spring breakup in 2025.

After giving effect to the increase in capital expenditures, lower natural gas prices, the Equity Offering and the New Credit Facilities, Logan has revised its 2024 guidance as follows:

For the year ending December 31, 2024

Previous

Guidance

Updated

Guidance

Change

%

Average production (BOE/d) (1)

8,700

8,700

–

–

% Liquids

33%

34%

1%

3

Forecast Average Commodity Prices (2)

WTI crude oil price (US$/bbl)

75.49

75.67

0.18

0

AECO natural gas price ($/GJ)

1.76

1.48

(0.28

)

(16

)

Average exchange rate (CA$/US$)

1.365

1.356

(0.009

)

(1

)

Operating Netback, after hedging ($/BOE) (1)(3)

19.77

18.40

(1.37

)

(7

)

Adjusted Funds Flow ($MM) (1)(3)

55

52

(3

)

(5

)

AFF per share, basic (3)

0.12

0.11

(0.01

)

(8

)

Capital Expenditures before A&D ($MM) (3)

120

140

20

17

Net Debt (Surplus), end of year ($MM) (3)

24

18

(6

)

(25

)

Common Shares outstanding, end of year (MM) (4)

466

507

41

9

(1) Additional information regarding the assumptions used in the forecasts of average production, Operating Netback and Adjusted Funds Flow are provided under “Reader Advisories” below.

(2) Forecast average commodity prices used in Updated Guidance are based on actual prices for the first six months of 2024 and forecast prices for the six months ending December 31, 2024, as follows: US$72.58/bbl WTI; CA$1.32/GJ AECO; and $1.353 CA$/US$ exchange rate. Refer to “Reader Advisories” for sensitivities.

(3) “Operating Netback, after hedging”, “Adjusted Funds Flow”, “AFF per share”, “Capital Expenditures before A&D” and “Net Debt (Surplus)” do not have standardized meanings under IFRS Accounting Standards, see “Non-GAAP Measures and Ratios” section of this press release.

(4) Estimated basic Common Shares outstanding assuming closing of the Equity Offering. Refer to additional information regarding outstanding dilutive securities under the heading of “Share Capital” in this press release.

PRELIMINARY 2025 BUDGET

Logan is pleased to provide a fully funded preliminary budget for 2025, focused on delivering material liquids growth, an inaugural Duvernay program and accelerated Pouce Coupe development. The 2025 capital expenditure budget of $170 million is elevated relative to other years within Logan’s five year plan due to the one-time Pouce Coupe infrastructure costs.

In addition to constructing and commissioning the Pouce Coupe infrastructure, the Company plans to bring onstream eight wells at Pouce Coupe, four Simonette Montney wells, and two Duvernay wells. Logan also plans to drill two DUC wells at Flatrock in 2025 which were deferred from 2024 and replaced with the land earning Duvernay well drilled at Ante Creek during the second quarter of 2024.

This 2025 budget delivers (from 2024E to 2025E):

47% average production growth;

61% oil and condensate growth;

24% decrease in average per unit operating and transportation costs;

98% Adjusted Funds Flow growth; and

82% Adjusted Funds Flow per share growth after giving effect to the Equity Offering.

For the year ending December 31, 2025

Preliminary

Budget

2025 Average Production (BOE/d) (1)

12,800

% Liquids

37%

H2 2025 Average Production (BOE/d)

14,500

% Liquids

38%

Forecast Average Commodity Prices (2)

WTI crude oil price (US$/bbl)

70.00

AECO natural gas price ($/GJ)

2.50

Average exchange rate (CA$/US$)

1.350

Operating Netback, after hedging ($/BOE) (1)(3)(4)

25.92

Adjusted Funds Flow ($MM) (1)(3)

102

AFF per share, basic

0.20

Capital Expenditures before A&D ($MM) (3)

170

DCET

125

Infrastructure, land and other

45

Net Debt, end of year ($MM) (3)

86

Common Shares outstanding, end of year (MM) (5)

507

(1) Additional information regarding the assumptions used in the forecasts of average production, Operating Netback and Adjusted Funds Flow are provided under “Reader Advisories” below.

(2) Refer to “Reader Advisories” for sensitivities.

(3) “Operating Netback, after hedging”, “Adjusted Funds Flow”, “AFF per share”, “Capital Expenditures before A&D” and “Net Debt (Surplus)” do not have standardized meanings under IFRS Accounting Standards, see “Non-GAAP Measures and Ratios” section of this press release.

(4) A summary of outstanding commodity price risk management contracts is provided under the heading “Reader Advisories – Assumptions for Guidance – Commodity Hedging”.

(5) Estimated basic Common Shares outstanding assuming closing of the Equity Offering. Refer to additional information regarding outstanding dilutive securities under the heading of “Share Capital” in this press release.

ABOUT LOGAN ENERGY CORP.

Logan is a growth-oriented exploration, development and production company formed through the spin-out of the early stage Montney assets of Spartan Delta Corp. Logan was founded with a strong initial capitalization and three high quality and opportunity rich Montney assets located in the Simonette and Pouce Coupe areas of northwest Alberta and the Flatrock area of northeastern British Columbia and has recently established a position within the greater Kaybob Duvernay oil play with assets in the North Simonette and Ante Creek areas. The management team brings proven leadership and a track record of generating excess returns in various business cycles.

For additional information, please contact:

Richard F. McHardy

Logan Energy Corp.

Chief Executive Officer

1800, 736 – 6th Avenue SW

Calgary, Alberta T2P 3T7

Brendan Paton

Email: info@loganenergycorp.com

President and Chief Operating Officer

https://www.loganenergycorp.com/

READER ADVISORIES

Non-GAAP Measures and Ratios

This press release contains certain financial measures and ratios which do not have standardized meanings prescribed by International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS Accounting Standards“), also known as Canadian Generally Accepted Accounting Principles (“GAAP“). As these non-GAAP financial measures and ratios are commonly used in the oil and gas industry, Logan believes that their inclusion is useful to investors. The reader is cautioned that these amounts may not be directly comparable to measures for other companies where similar terminology is used.

The non-GAAP measures and ratios used in this press release, represented by the capitalized and defined terms outlined below, are used by Logan as key measures of financial performance and are not intended to represent operating profits nor should they be viewed as an alternative to cash provided by operating activities, net income or other measures of financial performance calculated in accordance with IFRS Accounting Standards.

The definitions below should be read in conjunction with the “Non-GAAP and Other Financial Measures” section of the Company’s MD&A dated August 21, 2024, which includes discussion of the purpose and composition of the specified financial measures and detailed reconciliations to the most directly comparable GAAP financial measures.

Operating Income and Operating Netback

Operating Income, a non-GAAP financial measure, is a useful supplemental measure that provides an indication of the Company’s ability to generate cash from field operations, prior to administrative overhead, financing and other business expenses. “Operating Income, before hedging” is calculated by Logan as oil and gas sales, net of royalties, plus processing and other revenue, less operating and transportation expenses. “Operating Income, after hedging” is calculated by adjusting Operating Income, before hedging for realized gains or losses on derivative financial instruments.

The Company refers to Operating Income expressed per unit of production as an “Operating Netback” and reports the Operating Netback before and after hedging, both of which are non-GAAP financial ratios. Logan considers Operating Netback an important measure to evaluate its operational performance as it demonstrates its field level profitability relative to current commodity prices.

Adjusted Funds Flow

Cash provided by operating activities is the most directly comparable measure to Adjusted Funds Flow. “Adjusted Funds Flow” is reconciled to cash provided by operating activities by excluding changes in non-cash working capital, adding back transaction costs on acquisitions (if applicable). Logan utilizes Adjusted Funds Flow as a key performance measure in the Company’s annual financial forecasts and public guidance.

The Company refers to Adjusted Funds Flow expressed per unit of production as an “Adjusted Funds Flow Netback“.

Adjusted Funds Flow per share (“AFF per share“)

AFF per share is a non-GAAP financial ratio used by the Logan as a key performance indicator. The basic and/or diluted weighted average Common Shares outstanding used in the calculation of AFF per share is calculated using the same methodology as net income per share.

Capital Expenditures before A&D

“Capital Expenditures before A&D” is used by Logan to measure its capital investment level compared to the Company’s annual budgeted capital expenditures for its organic drilling program. It includes capital expenditures on exploration and evaluation assets and property, plant and equipment, before acquisitions and dispositions. The directly comparable GAAP measure to capital expenditures is cash used in investing activities.

Net Debt (Surplus)

Throughout this press release, references to “Net Debt (Surplus)” includes any long-term debt outstanding on the Company’s revolving and term credit facilities, net of Adjusted Working Capital. Net Debt and Adjusted Working Capital are both non-GAAP financial measures. “Adjusted Working Capital” is calculated as current liabilities less current assets, excluding derivative financial instrument assets and liabilities.

Supplementary Financial Measures

The supplementary financial measures used in this press release (primarily average sales price per product type and certain per BOE and per share figures) are either a per unit disclosure of a corresponding GAAP measure, or a component of a corresponding GAAP measure, presented in the financial statements. Supplementary financial measures that are disclosed on a per unit basis are calculated by dividing the aggregate GAAP measure (or component thereof) by the applicable unit for the period. Supplementary financial measures that are disclosed on a component basis of a corresponding GAAP measure are a granular representation of a financial statement line item and are determined in accordance with GAAP.

Assumptions for Guidance

Logan expects production to average approximately 8,700 BOE/d during 2024 (unchanged) and 12,800 BOE/d in 2025. The significant assumptions used in the forecast of Operating Netbacks and Adjusted Funds Flow for the Company’s 2024 and 2025 Guidance are summarized below.

Production Guidance

2024

Previous

Guidance

2024

Updated

Guidance

Change %

2025

Preliminary

Budget

Crude Oil (bbls/d)

1,925

2,025

5

3,045

Condensate (bbls/d)

630

600

(5

)

1,190

Crude oil and condensate (bbls/d)

2,555

2,625

3

4,235

NGLs (bbls/d)

320

310

(3

)

465

Natural gas (mcf/d)

34,950

34,590

(1

)

48,600

Combined average (BOE/d)

8,700

8,700

–

12,800

% Liquids

33%

34%

3

37%

Financial Guidance ($/BOE)

Oil and gas sales

37.89

36.17

(5

)

40.42

Processing and other revenue

0.96

0.93

(3

)

0.55

Royalties

(3.40

)

(3.41

)

0

(3.30

)

Transportation expenses

(3.22

)

(3.26

)

1

(2.50

)

Operating expenses

(12.62

)

(12.62

)

–

(9.54

)

Operating Netback, before hedging

19.61

17.81

(9

)

25.63

Realized gain (loss) on derivatives

0.16

0.59

269

0.29

Operating Netback, after hedging

19.77

18.40

(7

)

25.92

General and administrative expenses

(1.95

)

(1.95

)

–

(1.54

)

Financing expenses

(0.20

)

(0.04

)

(80

)

(1.64

)

Current income taxes

–

–

–

(0.50

)

Settlement of decommissioning obligations

(0.53

)

(0.20

)

(62

)

(0.38

)

Adjusted Funds Flow

17.09

16.21

(5

)

21.86

Guidance Sensitivities

Changes in forecast commodity prices, exchange rates, differences in the amount and timing of capital expenditures, and variances in average production estimates can have a significant impact on the key performance measures included in Logan’s guidance for 2024 and 2025. The Company’s actual results may differ materially from these estimates. Holding all other assumptions constant, the table below shows the impact to forecasted Adjusted Funds Flow of a US$10/bbl change in the WTI crude oil price, a ~15% change in the AECO natural gas price, and a $0.05 change in the CA$/US$ exchange rate. Assuming capital expenditures are unchanged, an increase (decrease) in Adjusted Funds Flow will result in an equivalent decrease (increase) in forecasted Net Debt.

Six Months Ending December 31, 2024 – Change in Adjusted Funds Flow ($MM)

AECO / WTI

US$62.58/bbl

US$72.58/bbl

US$82.58/bbl

CA$/US$

FX Impact

$1.12/GJ

($4)

($1)

$0

1.30

($0)

$1.32/GJ

($3)

–

$2

1.35

–

$1.52/GJ

($2)

$1

$3

1.40

$0

Year Ending December 31, 2025 – Change in Adjusted Funds Flow ($MM)

AECO / WTI

US$60.00/bbl

US$70.00/bbl

US$80.00/bbl

CA$/US$

FX Impact

$2.15/GJ

($21)

($5)

$6

1.30

($3)

$2.50/GJ

($14)

–

$11

1.35

–

$2.85/GJ

($8)

$5

$16

1.40

$3

Commodity Hedging

The following table summarizes the Company’s financial risk management contracts in place as of the date hereof:

Commodity /

Contract Type

Notional

Volume

Reference

Price

Fixed

Contract Price

Remaining

Term

Crude oil – swap

1,500 bbls/d

WTI – NYMEX

CA$101.33 per barrel

September 1 to December 31, 2024

Crude oil – swap

100 bbls/d

WTI – NYMEX

US$74.35 per barrel

October 1 to December 31, 2024

Crude oil – swap

250 bbls/d

WTI – NYMEX

US$72.75 per barrel

January 1 to March 31, 2025

Crude oil – swap

500 bbls/d

WTI – NYMEX

CA$102.05 per barrel

January 1 to December 31, 2025

Crude oil – short call

500 bbls/d

WTI – NYMEX

CA$102.05 per barrel

January 1 to December 31, 2025

Natural gas – swap

20,000 GJ/d

AECO

CA$1.63 per GJ

September 1 to 30, 2024

Natural gas – swap

22,500 GJ/d

AECO

CA$0.86 per GJ

October 1 to 31, 2024

Natural gas – swap

20,000 GJ/d

AECO

CA$1.86 per GJ

November 1 to 30, 2024

Natural gas – swap

5,000 GJ/d

AECO

CA$2.50 per GJ

January 1 to March 31, 2025

Natural gas – swap

10,000 GJ/d

AECO

CA$2.23 per GJ

April 1 to October 31, 2025

Drilling Locations

All of the over 140 net extended reach horizontal Duvernay oil drilling locations disclosed in this press release are unbooked locations. Unbooked locations are internal estimates based on the Company’s assumptions as to the number of wells that can be drilled per section based on industry practice and internal review, being 600m inter well spacing and an average horizontal well length of ~3,500m. Unbooked locations do not have attributed reserves or resources. Unbooked locations have been identified by management as an estimation of Logan’s multi-year drilling activities based on evaluation of applicable geologic, seismic, engineering, production and reserves information. There is no certainty that the Company will drill all unbooked drilling locations and if drilled there is no certainty that such locations will result in additional oil and gas reserves, resources or production. The drilling locations on which the Company actually drills wells will ultimately depend upon the availability of capital, regulatory approvals, seasonal restrictions, oil and natural gas prices, costs, actual drilling results, additional reservoir information that is obtained and other factors. While certain of the unbooked drilling locations have been de-risked by drilling existing wells in relative close proximity to such unbooked drilling locations, the majority of other unbooked drilling locations are farther away from existing wells where management has less information about the characteristics of the reservoir and therefore there is more uncertainty whether wells will be drilled in such locations and if drilled there is more uncertainty that such wells will result in additional oil and gas reserves, resources or production.

Analogous Information

In this press release, the Company has provided certain information on the prospectivity of wells on properties adjacent to the Company’s acreage which is “analogous information” as defined by applicable securities laws. This analogous information is derived from publicly available information sources which the Company believes are predominantly independent in nature. Some of this data may not have been prepared by qualified reserves evaluators or auditors and the preparation of any estimates may not be in strict accordance with the most recent publication of the Canadian Oil and Gas Evaluations Handbook. Regardless, estimates by engineering and geotechnical practitioners may vary and the differences may be significant. The Company believes that the provision of this analogous information is relevant to the Company’s activities and forecasting, given its property ownership in the area; however, readers are cautioned that there is no certainty that the forecasts provided herein based on analogous information will be accurate.

Other Measurements

All dollar figures included herein are presented in Canadian dollars, unless otherwise noted. This press release contains various references to the abbreviation “BOE” which means barrels of oil equivalent. Where amounts are expressed on a BOE basis, natural gas volumes have been converted to oil equivalence at six thousand cubic feet (mcf) per barrel (bbl). The term BOE may be misleading, particularly if used in isolation. A BOE conversion ratio of six thousand cubic feet per barrel is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead and is significantly different than the value ratio based on the current price of crude oil and natural gas. This conversion factor is an industry accepted norm and is not based on either energy content or current prices. Such abbreviation may be misleading, particularly if used in isolation.

References to “oil” in this press release include light crude oil, medium crude oil, heavy oil and tight oil combined. NI 51-101 includes condensate within the product type of “natural gas liquids”. References to “natural gas liquids” or “NGLs” include pentane, butane, propane and ethane. References to “gas” or “natural gas” relates to conventional natural gas. References to “liquids” includes crude oil, condensate and NGLs.

Share Capital

Common shares of Logan trade on the TSXV under the symbol “LGN”.

As of the date hereof, there are 465.5 million Common Shares outstanding. Pro forma completion of the Equity Offering, there will be 506.6 million Common Shares outstanding. There are no preferred shares or special shares outstanding. Logan’s convertible securities outstanding as of the date of this press release include: 64.3 million Common Share purchase warrants with an exercise price of $0.35 per share expiring July 12, 2028; and 22.6 million stock options with an exercise price of $0.89 per share expiring November 22, 2028.

Forward-Looking and Cautionary Statements

Certain statements contained within this press release constitute forward-looking statements within the meaning of applicable Canadian securities legislation. All statements other than statements of historical fact may be forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “anticipate”, “budget”, “plan”, “endeavor”, “continue”, “estimate”, “evaluate”, “expect”, “forecast”, “monitor”, “may”, “will”, “can”, “able”, “potential”, “target”, “intend”, “consider”, “focus”, “identify”, “use”, “utilize”, “manage”, “maintain”, “remain”, “result”, “cultivate”, “could”, “should”, “believe” and similar expressions. Logan believes that the expectations reflected in such forward-looking statements are reasonable as of the date hereof, but no assurance can be given that such expectations will prove to be correct and such forward-looking statements should not be unduly relied upon. Without limitation, this press release contains forward-looking statements pertaining to: the Company’s five year growth plan; the completion of the Equity Offering and the New Credit Facilities and the terms and timing thereof and use of proceeds therefrom; satisfaction or waiver of the closing conditions to the Equity Offering and the New Credit Facilities; receipt of required regulatory and stock exchange approvals for the completion of the Equity Offering; insider participation in the Equity Offering; Logan’s upwardly revised 2024 capital expenditures guidance; Logan’s 2024 and 2025 capital budget, including drilling programs and infrastructure development and the timing and anticipated results thereof; the payout on the incremental capital to expand the battery as a gas plant; the Company’s opportunity rich assets (including in the Duvernay) which represent over a decade of tier one highly economic oil weighted inventory; management’s track record of generating excess returns in various business cycles; success of the Company’s drilling program based on initial results; future drilling plans; EUR; risk management activities, including hedging; continuing to advance key infrastructure projects; forecast production for the second half of 2024 and 2025; and the expectation that per unit operating expenses will decrease with production growth.

The forward-looking statements and information are based on certain key expectations and assumptions made in respect of Logan including expectations and assumptions concerning: the receipt of all approvals and satisfaction of all conditions to the completion of the Equity Offering and the New Credit Facilities; the business plan of Logan; the timing of and success of future drilling; development and completion activities and infrastructure projects; the performance of existing wells; the performance of new wells; the availability and performance of facilities and pipelines; the geological characteristics of Logan’s properties; the successful integration of the recently acquired assets into Logan’s operations; the successful application of drilling, completion and seismic technology; prevailing weather conditions; prevailing legislation affecting the oil and gas industry; prevailing commodity prices, price volatility, price differentials and the actual prices received for Logan’s products; impact of inflation on costs; royalty regimes and exchange rates; the application of regulatory and licensing requirements; the availability of capital (including under the Equity Offering and the New Credit Facilities), labour and services; the creditworthiness of industry partners; and the ability to source and complete acquisitions.

Although Logan believes that the expectations and assumptions on which such forward-looking statements and information are based are reasonable, undue reliance should not be placed on the forward-looking statements and information because Logan can give no assurance that they will prove to be correct. By its nature, such forward-looking information is subject to various risks and uncertainties, which could cause the actual results and expectations to differ materially from the anticipated results or expectations expressed. These risks and uncertainties include, but are not limited to: counterparty risk to closing the Equity Offering and the New Credit Facilities; fluctuations in commodity prices; changes in industry regulations and political landscape both domestically and abroad; wars, hostilities, civil insurrections; changes in legislation, including but not limited to tax laws, royalties and environmental regulations (including greenhouse gas emission reduction requirements and other decarbonization or social policies and including uncertainty with respect to the interpretation of omnibus Bill C-59 and the related amendments to the Competition Act (Canada)); foreign exchange or interest rates; increased operating and capital costs due to inflationary pressures (actual and anticipated); volatility in the stock market and financial system; impacts of pandemics; the retention of key management and employees; and risks with respect to unplanned pipeline outages and risks relating to inclement and severe weather events and natural disasters, such as fire, drought, flooding and extreme hot or cold temperatures, including in respect of safety, asset integrity and shutting-in production. Ongoing military actions in the Middle East and between Russia and Ukraine and related sanctions have the potential to threaten the supply of oil and gas from those regions. The long-term impacts of these actions remains uncertain. The foregoing list is not exhaustive. Please refer to the MD&A and AIF for discussion of additional risk factors relating to Logan, which can be accessed on its SEDAR+ profile at www.sedarplus.ca. Readers are cautioned not to place undue reliance on this forward-looking information, which is given as of the date hereof, and to not use such forward-looking information for anything other than its intended purpose. Logan undertakes no obligation to update publicly or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by law.

This press release contains future-oriented financial information and financial outlook information (collectively, “FOFI“) about Logan’s five year growth plan, Logan’s budget and guidance for 2024 and 2025, including with respect to prospective results of operations, production (including 8,700 BOE/d during 2024, 12,800 BOE/d in 2025 and growing to 20,000 to 25,000 BOE/d by 2028) and operating costs (including reducing its corporate operating cost to below $8.00 per BOE by 2028), including pro forma the completion of the Equity Offering and the New Credit Facilities, all of which are subject to the same assumptions, risk factors, limitations, and qualifications as set forth in the above paragraphs. FOFI contained in this document was approved by management as of the date of this document and was provided for the purpose of providing further information about Logan’s proposed business activities in the remainder of 2024 and 2025. Logan and its management believe that FOFI has been prepared on a reasonable basis, reflecting management’s best estimates and judgments, and represent, to the best of management’s knowledge and opinion, the Company’s expected course of action. However, because this information is highly subjective, it should not be relied on as necessarily indicative of future results. Logan disclaims any intention or obligation to update or revise any FOFI contained in this document, whether as a result of new information, future events or otherwise, unless required pursuant to applicable law. Readers are cautioned that the FOFI contained in this document should not be used for purposes other than for which it is disclosed herein. Changes in forecast commodity prices, exchange rates, differences in the timing of capital expenditures, and variances in average production estimates can have a significant impact on the key performance measures included in Logan’s guidance. The Company’s actual results may differ materially from these estimates.

This press release is not an offer of the securities for sale in the United States. The securities offered have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”)) or any U.S. state securities laws and may not be offered or sold in the United States absent registration or an available exemption from the registration requirement of the U.S. Securities Act and applicable U.S. state securities laws. This press release shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities, in any jurisdiction in which such offer, solicitation or sale would be unlawful.

Neither TSX Venture Exchange nor its regulation services provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Abbreviations

A&D

acquisitions and dispositions

AECO

Alberta Energy Company “C” Meter Station of the NOVA Pipeline System

AIF

refers to the Company’s Annual Information Form dated March 18, 2024

bbl

barrel

bbls/d

barrels per day

bcf

one billion cubic feet

BOE

barrels of oil equivalent

BOE/d

barrels of oil equivalent per day

CA$ or CAD

Canadian dollar

DCET

drilling, completion, equipping and tie-in capital expenditures

DUC

drilled, uncompleted well

EUR

estimated ultimate recovery

GJ

gigajoule

H2

second half of the year or six month period ending December 31

Mbbl

one thousand barrels

MBOE

one thousand barrels of oil equivalent

mcf

one thousand cubic feet

mcf/d

one thousand cubic feet per day

MMbtu

one million British thermal units

mmcf

one million cubic feet

mmcf/d

one million cubic feet per day

MD&A

refers to Management’s Discussion and Analysis of the Company dated August 21, 2024

MM

millions

$MM

millions of dollars

MPa

megapascal unit of pressure

NGL(s)

natural gas liquids

NI 51-101

National Instrument 51-101 – Standards of Disclosure for Oil and Gas Activities

nm

“not meaningful”, generally with reference to a percentage change

NYMEX

New York Mercantile Exchange, with reference to the U.S. dollar “Henry Hub” natural gas price index

TSXV

TSX Venture Exchange

US$ or USD

United States dollar

WTI

West Texas Intermediate, the reference price paid in U.S. dollars at Cushing, Oklahoma for crude oil of standard grad

A map accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/d5df0ee0-b12a-4b3a-bee1-b00b67a85785

The post Logan Energy Corp. Announces Duvernay Land Position, Accelerated Pouce Coupe Development, Preliminary 2025 Budget, $30 Million Equity Offering and Committed Credit Facilities of $125 Million appeared first on Invezz