September 09, 2024 8:00 AM EDT | Source: Bear Creek Mining Corporation

Vancouver, British Columbia–(Newsfile Corp. – September 9, 2024) – Bear Creek Mining Corporation (TSXV: BCM) (OTCQX: BCEKF) (BVL: BCM) (“Bear Creek” or the “Company”) is pleased to announce it is assessing potential development opportunities at its Corani property in Puno, Peru (“Corani”) which could enhance life of mine silver production, improve already robust economic returns and meaningfully lower capital intensity prior to first production.

The assessment covers the silver resource and recoverability potential of near-surface, silver-rich oxidized material (the “Oxides“) that occurs within the Este, Main, and Minas deposits at Corani. Under a revised development plan, the Oxides would be mined as a first phase of production for the proposed Corani open pit mine, followed by the development and extraction of silver-lead-zinc sulphide resources as outlined in the most recent Technical Report (as defined in National Instrument 43-101) for Corani (the “2019 Corani Report” or the “Sulfide Plan”).

The combined development plan will be summarized in a new preliminary economic assessment (“PEA”) which Bear Creek expects to announce the results of prior to the end of 2024.

Oxide Resources

The 2019 Corani Report estimates that Corani contains “potentially leachable material” (i.e. Oxides) totaling 39 million ounces of silver in measured and indicated Mineral Resource categories and 29.9 million ounces of silver in the inferred Mineral Resource category (see Table 1).

Table 1 – 2019 Mineral Resource for Potentially Leachable Material

Category

Tonnes (Mt)

Silver (g/t)

Silver (Moz)

Measured

4.3

28.9

4.0

Indicated

36.1

30.1

35.0

Measured and Indicated Subtotal

40.4

30.0

39.0

Inferred

24.3

38.2

29.0

Notes:

From the NI 43-101 Technical Report titled “Bear Creek Mining, Corani Project, NI 43-101 Technical Report” dated December 17, 2019, prepared for Bear Creek by Ausenco Services Pty Ltd and filed on SEDAR on December 17, 2019.

Oxides Mineral Resource estimate is based on a 15 g/t silver cutoff and is not included in the Mineral Reserve estimate disclosed in the 2019 Corani Report.

See 2019 Corani Report for information regarding the assumptions used in the preparation of these Mineral Resource estimates.

These Oxides were not included in the Proven and Probable Reserves of 229 million ounces of silver (at a grade of 51.3 gpt), 2.7 billion pounds of lead (at a grade of 0.90%) and 1.7 billion pounds of zinc (at a grade of 0.55%) that were outlined in the 2019 Corani Report, which focused solely on exploitation of the “sulfide” and “transitional” material.

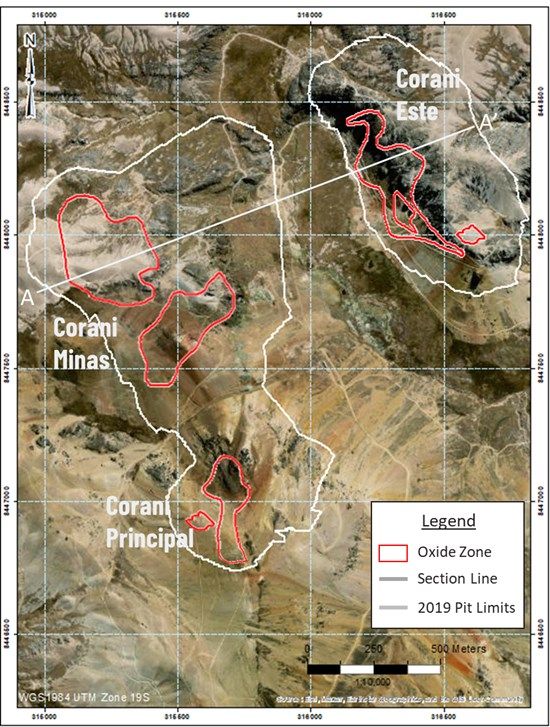

The Oxides outlined above are currently contained within the 2019 Mineral Reserve pit shells as waste, forming a portion of the 196 Mt of pre-stripping and waste that would be mined over the Corani mine life. If proven economically viable, mining of the Oxide resource would accelerate access to the underlying transitional and sulfide mineralization and reduce the strip ratio for the future Sulfide Plan. The location of the Oxides relative to the current Sulfide Plan pit limits are summarized in Figures 1 and 2.

The PEA is expected to evaluate the development of a five thousand tonne per day processing plant to treat oxide material mined in the first phase of production. As well, the viability of a smaller scale and simplified flowsheet relative to the Sulfide Plan will be assessed. If successful, the outcomes of the PEA could meaningfully reduce the capital intensity for Corani, while extending the overall mine life and improving overall project economics.

Figure 1 – Plan View of Corani Including Outline of Oxide Resources

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3376/222515_b2deb66fe40cca5f_001full.jpg

Figure 2 – Cross Section of Corani Minas and Este Deposits Including Oxide Resources

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3376/222515_b2deb66fe40cca5f_002full.jpg

Metallurgical Testing

As part of its re-evaluation of the Oxides, Bear Creek initiated a metallurgical program to test the recoverability of silver from the Oxide material. Bottle roll tests were conducted in 2024 (the “2024 Leach Tests”) on sixteen samples selected from four of nine fresh Corani metallurgical diamond drill cores drilled in 2023. The location, orientation, declination, and metallurgical oxide sample compilation details from the 4 mentioned diamond drill holes, are presented in Tables 4 and 5 below. The tests are designed to simulate amenability for both heap leach recovery with coarse crushed ½” samples (the “2024 Coarse Leach Tests”) and agitated leach recovery with fine ground 75-micron samples (the “2024 Fine Leach Tests”). The results from the 2024 Coarse Leach Tests were highly variable and require additional investigation to better understand. Silver extraction from the 2024 Fine Leach Tests ranged from 13% to 93% with elevated extractions on the higher-grade material. Filtering these results to remove samples with average silver grades below 30 gpt provides a weighted average silver extraction of 79%. The results from the 2024 Fine Leach Tests are similar to leach optimization tests conducted at Corani in 2009 (the “2009 Leach Tests”). The 2009 Leach Tests obtained an average 85% extraction of silver from oxide samples under similar test conditions (as reported in the 2011 Corani Report as defined below). A complete list of the test work results from the 2024 Leach Tests is presented in Tables 2 & 3 below. The results of the 2024 Leach Tests and 2009 Leach Tests are expected be incorporated into the PEA described above.

Table 2 – 2024 Fine Leach Test Results (Fine Ground Samples, P80 = 75 um)

Sample ID

Head Assay (Ag g/t)

Residual Grade (Ag g/t)

Extraction (%)

MT-OX-01

21.4

10.2

52.3

MT-OX-02

17.0

1.2

93.0

MT-OX-03

19.9

2.1

89.5

MT-OX-04

42.8

5.5

87.2

MT-OX-05

11.8

4.5

62.0

MT-OX-06

26.6

9.5

64.4

MT-OX-07

39.3

5.5

86.0

MT-OX-08

341.9

65.6

80.8

MT-OX-09

18.1

10.0

44.8

MT-OX-010

42.8

14.9

65.1

MT-OX-011

26.3

18.2

30.9

MT-OX-012

47.9

30.1

37.2

MT-OX-013

7.9

6.9

13.2

MT-OX-014

15.9

10.2

36.1

MT-OX-015

63.1

21.5

66.0

MT-OX-016

239.4

31.0

87.1

Table 3 – 2024 Coarse Leach Test Results (Course Ground Samples, 100%-1/2″)

Sample ID

Head Assay (Ag g/t)

Residual Grade (Ag g/t)

Extraction (%)

MT-OX-01

20.2

11.2

44.7

MT-OX-02

16.6

12.9

22.0

MT-OX-03

18.5

13.9

24.6

MT-OX-04

42.7

36.5

14.7

MT-OX-05

11.1

7.3

34.4

MT-OX-06

28.1

16.0

42.8

MT-OX-07

37.4

29.4

21.3

MT-OX-08

340.1

295.4

13.1

MT-OX-09

18.5

12.1

34.7

MT-OX-010

43.0

40.0

6.8

MT-OX-011

26.4

24.4

7.7

MT-OX-012

47.5

44.4

6.4

MT-OX-013

8.0

7.4

7.2

MT-OX-014

16.0

13.9

12.7

MT-OX-015

63.3

49.6

21.6

MT-OX-016

201.2

148.3

26.3

Technical Study Update and Timeline

Bear Creek has engaged Global Resource Engineering Ltd. to provide updated Mineral Resource estimates of the tonnage and grade of the Oxides using higher silver cutoff grades, the results of which will be incorporated into the PEA. The PEA is being developed by M3 Engineering and will include an economic analysis of the potential viability of producing silver from the Oxides via agitated leach processing, as a precursor to the production of silver, lead and zinc in the Sulfide Plan outlined in the 2019 Corani Report. The Company expects to announce the results of the PEA prior to the end of 2024.

Table 4 – Corani Oxide 2024 Metallurgical Sampling: Location, length, orientation, and declination of 2023 Metallurgical Diamond Drillholes.

2023 DDH

(Hole #)

Easting

(m PSAD56)

Northing

(m PSAD56)

Elevation

(m PSAD56)

Length

(m)

Vertical Depth

(m)

Azimuth

(degrees)

Declination

(degrees)

C241

315890.6

8447341.0

5066.5

161.4

161.4

339.59

-90

C244

315621.1

8447980.4

5030.5

80.4

80.4

232.22

-90

C245

316524.6

8448535.7

4927.5

148

148

269.74

-90

C248

316568.5

8448646.2

4977.3

205.4

205.4

323.42

-90

Table 5: – Corani Oxide 2024 Metallurgical Sampling: Metallurgical sample compilation details for sampled 2023 Drillhole Intervals.

2024 Met

Sample

2023

DDH

From

To

Interval

Description

Test Silver

Range

Silver

Grade

(Sample #)

(Hole #)

(m)

(m)

(m)

(Lithology)

(Ag g/t)

(ppm)

MT-Ox-01

248

84

86

2

Volcanics

10-25

21.1

248

86

88

2

Volcanics

10-25

18.1

248

88

90

2

Volcanics

10-25

21.1

MT-Ox-02

248

64

66

2

Volcanics

25-50

21.4

248

68

70

2

Volcanics / Si-veins

25-50

14.9

248

70

72

2

Volcanics

25-50

10.4

MT-Ox-03

245

3.2

5

1.5

Porphyritic volcanics

50-75

64.4

248

60

62

2

Oxide breccias

50-75

36.7

248

66

68

2

Volcanics

50-75

31.2

MT-Ox-04

248

62

64

2

Volcanics

≥75

50.2

MT-Ox-05

245

13

15

2

Porphyritic volcanics

10-25

15.5

248

76

78

2

Volcanics

10-25

4.7

248

78

80

2

Volcanics

10-25

10.6

MT-Ox-06

245

15

17

2

Porphyritic volcanics

25-50

30.6

245

17

19

2

Porphyritic volcanics

25-50

23.3

245

19

21

2

Porphyritic volcanics

25-50

18

MT-Ox-07

245

5

7

2

Porphyritic volcanics

50-75

57.3

248

58.35

60

1.65

Oxide breccias

50-75

55.4

MT-Ox-08

245

7

9

2

Hydrothermal breccia

≥75

>100

245

9

11

2

Hydrothermal breccia

≥75

>100

245

11

13

2

Hydrothermal breccia

≥75

>100

MT-Ox-09

244

66

68

2

Crystal tuff

10-25

13.7

244

76

77.5

1.5

Crystal tuff

10-25

3.8

MT-Ox-10

244

32

34

2

Obliterated volcanics

25-50

14

244

50

52

2

Andesitic lava

25-50

14.2

244

64

66

2

Crystal tuff

25-50

24

MT-Ox-11

244

6

8

2

Oxidized andesitic lava

50-75

21.3

244

52

54

2

Andesitic lava

50-75

18.2

244

54

56

2

Crystal tuff

50-75

19.6

MT-Ox-12

244

4

6

2

Andesitic lava

≥75

36.6

244

44

46

2

OxFe structures

≥75

49.7

244

58

60

2

Crystal tuff

≥75

34.4

MT-Ox-13

241

0

2

2

Lithic & crystal tuffs

10-25

6.5

241

4

6

2

Lithic & crystal tuffs

10-25

11.4

241

10

12

2

Lithic & crystal tuffs

10-25

8.5

MT-Ox-14

241

12

14

2

Lithic & crystal tuffs

25-50

15.6

MT-Ox-15

241

18

20

2

Lithic tuff & hydr.breccia

50-75

28.4

241

27

29

2

Ba-rich FeOx, chalcedonic qtz

50-75

67.2

MT-Ox-16

241

20

22

2

Hydrothermal breccia

≥75

>100

241

22

24

2

Oxides, Qtz & Ba-rich

≥75

>100

241

24

25.6

1.6

Ba-rich FeOx, chalcedonic qtz

≥75

>100

On behalf of the Board of Directors,

Eric Caba

President and Chief Executive Officer

NI 43-101 Disclosure

The work programs described in this announcement are being conducted under the supervision of Donald Mc Iver, Fellow SEG and Fellow Aus IMM, Vice President, Exploration and Geology of Bear Creek Mining Corporation, who is a qualified person (“QP”) as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects. Mr. Mc Iver physically reviewed the relevant 2023 diamond drill core from which the 2024 metallurgical test samples were selected, in the secure Bear Creek core-shack facility located in the Andean city of Juliaca. He verifies that there is no drilling, sampling, drill core recovery or other factors of which he is aware that could materially affect the representativity, accuracy or reliability of the data presented above. Mr. Mc Iver has reviewed and approves the scientific and technical information presented in this news release.

Bear Creek Mining Quality Assurance and Quality Control Disclosure

To ensure best industry practice in the sampling and analyzing of Exploration and mineral resource samples, the Company administers a NI 43-101 compliant quality assurance and quality control (QAQC) protocol on all metal & mineral projects. Analytical results received from commercial and mine-site laboratories are captured into the database and reported only after results from rigorous procedural QAQC checks have been reviewed and approved. An independent check on contamination, precision and accuracy in the analytical laboratory is ensured through the monitoring of results obtained from fine & coarse blank samples, certified reference materials, and coarse field & fine sample-preparation duplicates inserted into the sample stream for each batch of samples (up to 84 in number), to be analyzed.

At the producing Mercedes Mine, logging and sampling of drill core and channel samples are completed at a secure onsite facility. Mineral Resource diamond drilling generally recovers HQ-diameter core. The core is split into equal halves and half-drill-core samples and representative channel samples are securely transported from the mine-site to the commercial ALS Chemex sample preparation installations located in Hermosillo, Mexico. After preparation, sample pulps are shipped by air to the ALS Chemex analytical laboratory

in Vancouver, British Columbia, for gold and silver analysis. Gold content is determined by fire assay on a 30-gram charge and silver content by four-acid digestion. The ALS-Chemex sample preparation and assay laboratories are independent of Bear Creek.

Bear Creek is unaware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the Mineral Resource assay data referred to herein.

The 2019 Corani Report refers to the Technical Report titled “Bear Creek Mining, Corani Project, NI 43-101 Technical Report” dated December 17, 2019, prepared for Bear Creek Mining Corporation by Ausenco Services Pty Ltd and filed on SEDAR on December 17, 2019, which is available on SEDAR+ (www.sedarplus.ca) under the profile of the Company.

The 2011 Corani Report refers to the Technical Report titled “Corani Project, Form NI 43-101F1 Technical Report Feasibility Study” dated December 22, 2011, prepared for Bear Creek Mining by M3 Engineering and filed on SEDAR on December 22, 2011, which is available on SEDAR+ (www.sedarplus.ca) under the profile of the Company.

The 2019 Corani Report Proven and Probable Mineral Reserves include 20.3 million tonnes of Proven Mineral Reserves for 30 million ounces of silver, 450.0 million pounds of lead and 268.5 million pounds of zinc (at 59.7 gpt silver, 1.0 % lead, and 0.6% zinc) and 118.3 million tonnes of Probable Mineral Reserves 189.6 million ounces of Silver, 2.291 billion pounds of lead, and 1.426 billion pounds of zinc (at 49.9 gpt silver, 0.88% lead, and 0.55% zinc).

The 40.4 million tonnes at 30.0 gpt for 39.0 million ounces of silver of “potentially leachable material” (i.e. Oxides) in the measured and indicated mineral resource categories disclosed in the 2019 Corani Report, are comprised of 4,3 million tonnes of measured mineral resources at 28.9 gpt silver and 36,1 million tonnes of Indicated mineral resources at 30.1 gpt silver.

Cautionary Statement Regarding Forward-Looking Statements

This news release contains forward-looking statements regarding: the potential outcome of current and planned test work programs at Corani and the timing of completion thereof; the development of the Oxides as the first phase of production at Corani; the Company’s intention to complete a PEA for Corani; the anticipated ability to economically leach silver from the Oxides; the anticipated benefits that may result from exploitation from the Oxides material in addition to the previously planned Corani mine; the Company’s ability to increase Corani’s life of mine, improve the economic projections for Corani or provide a less capital-intensive entry to Corani production; and whether the Company’s plans will form a catalyst for project financing.

In making the forward-looking statements included in this news release, the Company has applied several material assumptions, including, but not limited to assumptions related to the Company’s planned development and operating activities, business objectives, goals and capabilities, assumptions related to gold and silver prices, and the expectation that anticipated development and operating results will not differ materially from expectations. As of its last reported financial results the Company had a working capital deficiency. There is no guarantee that sufficient funds will be available to meet the Company’s financial obligations, and the Company may be required to raise funds through the issuance of equity or by other means. There can be no assurances that such funding will be available, and if so, under acceptable terms and conditions. Although management considers the assumptions underlying its forward-looking statement to be reasonable based on information available to it, they may prove to be incorrect.

By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, and the risk exists that estimates, forecasts, projections, and other forward-looking statements will not be achieved or that assumptions on which they are based do not reflect future experience. We caution readers not to place undue reliance on these forward-looking statements as a number of important factors could cause the actual outcomes to differ materially from the expectations expressed in them. These risk factors may be generally stated as the risk that the assumptions expressed above do not occur but may include additional risks as described in the Company’s latest Annual Information Form, and other disclosure documents filed by the Company on SEDAR+. The foregoing list of factors that may affect future results is not exhaustive. Investors and others should carefully consider the foregoing factors and other uncertainties and potential events. The Company does not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by the Company or on behalf of the Company, except as required by law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/222515

SOURCE: Bear Creek Mining Corporation

The post Bear Creek Mining Announces Potential for Lower Capex, Longer-Mine Life at Corani via Initial Mining of Oxide Resources appeared first on Invezz