September 03, 2024 6:30 AM EDT | Source: Imagine Lithium Inc.

Vancouver, British Columbia–(Newsfile Corp. – September 3, 2024) – Imagine Lithium Inc. (TSXV: ILI) (OTCQB: ARXRF) (the “Company” or “Imagine”), is pleased to announce an initial NI 43-101 compliant lithium Mineral Resource Estimate (“MRE”) on its Jackpot Property, located near the Town of Nipigon, Ontario.

Imagine will be hosting a webinar today at 11am EDT to discuss the resource estimate in more detail. Please register here: https://us02web.zoom.us/webinar/register/WN_dtW8UznRTv-MiX8Jsrt_5g

The webinar will be recorded for post viewing.

Jackpot Property Highlights:

Indicated MRE of 3.1 Mt at 0.85% Li2O contains 26.2 kt of Li2O

Inferred MRE of 5.3 Mt at 0.91% Li2O contains 49.5 kt of Li2O

The MRE exhibits excellent mineralized continuity through a range of Li2O cut-off grades up to 0.5% Li2O

Casino Royale is defined by eight diamond drill holes and remains open in all directions

Additional nearby targets from previous exploration work provides excellent future Mineral Resource expansion potential

Metallurgical test work by SGS Canada achieved an overall Li2O recovery up to 81.5%

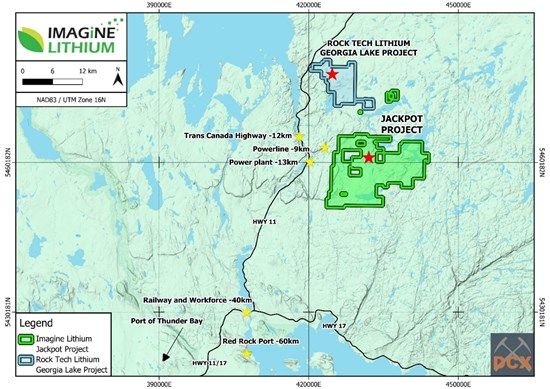

The Project is well serviced by existing infrastructure with access to nearby power sources and is approximately 40 km from the Town of Nipigon and 150 km from the port of Thunder Bay and 60 km from a potential port at Red Rock (Figure 1). Jackpot is proximal to the Great Lakes and St-Lawrence Seaway giving shipping access to processing plants globally, as well as Giga factories planned for southern Ontario and a possible lithium hydroxide plant contemplated for Thunder Bay or Red Rock.

J.C. St-Amour, Imagine President commented: “The initial MRE gives Imagine an excellent starting point on which to build Mineral Resources in the near future. There are several areas of the Deposit which remain open as well as new pegmatite targets which are untested. I cannot stress enough the importance and value of the Project’s location. The nearby infrastructure is a major advantage for future development of the Project as its proximity to a workforce, power, highway and ports, distinguishes Jackpot from other lithium projects which are much more remote and therefore expensive to develop. In addition, our MRE compares favourably to other deposits in the area, including Rock Tech’s Georgia Lake Project, located 15 km to the north of Jackpot. The unexplored potential on the Property gives us momentum to find and build additional lithium Mineral Resources.”

Table 1: Pit-Constrained Mineral Resource Estimate at 0.30% Li2O Cut-off(1-9)

Classification

Tonnes

M

Li2O

%

Li2O

k tonnes

Indicated

3.1

0.85

26.2

Inferred

5.3

0.91

49.5

Mineral Resources are not Mineral Reserves and have not demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio political, marketing, or other relevant issues.

The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration, however there is no certainty an upgrade to the Inferred Mineral Resource would occur or what proportion would be upgraded to an Indicated Mineral Resource.

The Mineral Resources were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Standards on Mineral Resources and Reserves, Definitions and Guidelines (2014) prepared by the CIM Standing Committee on Reserve Definitions and adopted by CIM Council and CIM Best Practices Guidelines (2019).

The following parameters were used to derive the Li2O cut-off value used to define the Mineral Resource:

August 2024 Consensus Economics long term forecast Li2O price US$1,100/t.

Exchange rate of US$0.73 = C$1.00.

Process recovery of 81.5%.

The 0.30% Li2O cut-off was derived from C$2.75/t mineralized mining, C$2.25/t waste mining, C$40/t processing and C$20/t G&A.

Pit slopes were 50 degrees.

Figure 1: Jackpot Property located next to Trans-Canada Highway, power, port, railroad, and workforce.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2962/221892_c7431ae62425797a_002full.jpg

Table 2: Pit-Constrained Mineral Resource Estimate Sensitivity*

Indicated

Inferred

Cut-Off

Li2O %

Tonnes

M

Li2O

%

Li2O

k tonnes

Tonnes

M

Li2O

%

Li2O

k tonnes

0.50

2.6

0.93

24.3

4.8

0.96

47.3

0.45

2.8

0.90

24.9

5.0

0.95

48.3

0.40

2.9

0.88

25.4

5.2

0.93

48.9

0.35

3.0

0.87

25.8

5.3

0.92

49.3

0.30

3.1

0.85

26.2

5.3

0.91

49.5

*See notes under Table 1.

The pit-constrained Mineral Resources are contained in two optimized conceptual open pits, the Jackpot Pit and the Casino Royale Pit (Figure 2). The Jackpot Pit contains a 3.1 Mt grading 0.85% Li2O of Indicated Mineral Resources and 2.2 Mt grading 0.82% Li2O of Inferred Mineral Resources, whereas the Casino Royale Pit contains Inferred Mineral Resources of 3.1 Mt at 1.00% Li2O. The Casino Royale Zone remains open in all directions and exploration efforts are continuing to focus on expanding this new discovery (Figure 3).

Figure 2: Jackpot Project area showing the optimized conceptual Jackpot Pit and Casino Royale Pit boundaries.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2962/221892_c7431ae62425797a_003full.jpg

Figure 3: Casino Royale Pit boundary containing 3.1 Mt Inferred MRE @ 1.00% Li2O in eight diamond drill holes.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2962/221892_c7431ae62425797a_004full.jpg

The mineralized wireframes were developed in GEMSTM with a 2.0 m minimum down hole width and a maximum 75 m projection distance from the nearest drill hole intercept. Wireframe constrained assays were composited to 1.0 m lengths and capped at 2.5% Li2O. A LeapfrogTM block model with 2.0 m x 2.0 m x 2.0 m blocks was established and subsequent inverse distance squared grade estimation undertaken. Bulk density averaging 2.69 t/m3 was determined from 18 site visit samples. A cut-off value of 0.30% Li2O within an optimized conceptual pit shell using NPV SchedulerTM was used to quantify the Mineral Resource Estimate, which has a reasonable prospect of eventual economic extraction (Figure 4). Exploration efforts will focus on infill drilling between the Jackpot Pit shell and Casino Royale Pit, and step out drilling north and east of the Casino Royale Pit (Figure 5).

Figure 4: Isometric view of the optimized conceptual Jackpot Pit and Casino Royale Pit with mineralized wireframes.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2962/221892_c7431ae62425797a_005full.jpg

Figure 5: Idealized cross-section looking west of Jackpot Pit and Casino Royale Pit.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2962/221892_c7431ae62425797a_006full.jpg

An NI 43-101 Technical Report will be filed on SEDAR+ within 45 days of this news release

Qualified Persons

The technical content of this news release was reviewed and approved by Eugene Puritch, P.Eng., FEC, CET, President of P&E Mining Consultants Inc an Independent Qualified Person as defined by the National Instrument 43-101.

About Imagine Lithium Inc.

Imagine is a junior mining exploration company focused on seeking and acquiring world-class mineral projects. The company holds the Jackpot Lithium Property located in the Georgia Lake area about 140 km NNE of Thunder Bay, Ontario, is approximately 12 km by road from the Trans-Canada Highway (Hwy 11), and is in proximity to sources of power, railroads, and ports. The Jackpot Property consists of 297 mineral claims covering 18,800 hectares.

On Behalf Of The Board

“J.C. St-Amour”

J.C. St-Amour, President

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statement: This news release contains forward-looking statements, which relate to future events or future performance and reflect management’s current expectations and assumptions. Such forward-looking statements reflect management’s current beliefs and are based on assumptions made by and information currently available to the Company. Investors are cautioned that these forward-looking statements are neither promises nor guarantees and are subject to risks and uncertainties that may cause future results to differ materially from those expected. These forward -looking statements are made as of the date hereof and, except as required under applicable securities legislation, the Company does not assume any obligation to update or revise them to reflect new events or circumstances. All the forward-looking statements made in this press release are qualified by these cautionary statements and by those made in our filings with SEDAR+ in Canada (available at www.sedarplus.ca).

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/221892

SOURCE: Imagine Lithium Inc.

The post Imagine Lithium Releases Initial Mineral Resource at Jackpot Property – Announces 3.1 Mt at 0.85% Li2O Indicated and 5.3 Mt at 0.91% Li2O Inferred Mineral Resources appeared first on Invezz