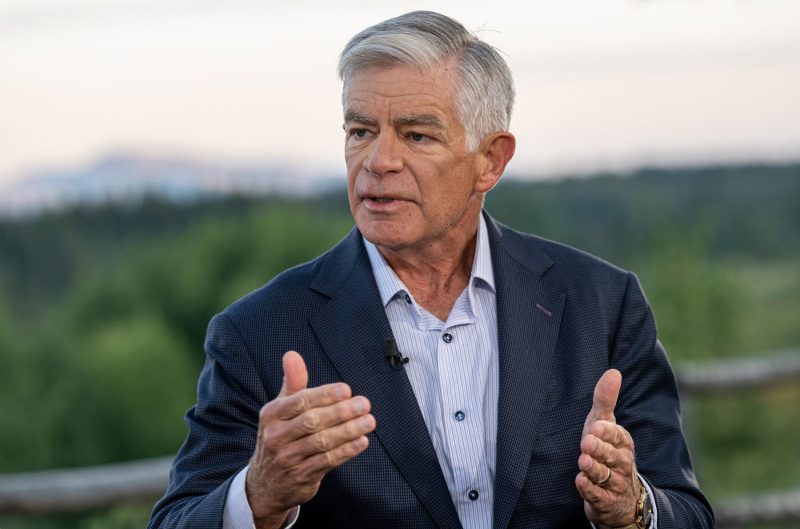

Philadelphia Federal Reserve President Patrick Harker on Thursday provided a strong endorsement to an interest rate cut on the way September.

Speaking to CNBC from the Fed’s annual retreat in Jackson Hole, Wyoming, Harker gave the most direct statement yet from a central bank official that monetary policy easing is almost a certainty when officials meeting again in less than a month.

The position comes a day after minutes from the last Fed policy meeting gave a solid indication of a cut ahead, as officials gain more confidence in where inflation is headed and look to head off any potential weakness in the labor market.

“I think it means this September we need to start a process of moving rates down,” Harker told CNBC’s Steve Liesman during a “Squawk on the Street” interview. Harker said the Fed should ease “methodically and signal well in advance.”

With markets pricing in a 100% certainty of a quarter percentage point, or 25 basis point, cut, and about a 1-in-4 chance of a 50 basis point reduction, Harker said it’s still a toss-up in his mind.

“Right now, I’m not in the camp of 25 or 50. I need to see a couple more weeks of data,” he said.

The Fed has held its benchmark overnight borrowing rate in a range between 5.25%-5.5% since July 2023 as it tackles a lingering inflation problem. Markets briefly rebelled after the July Fed meeting when officials signaled they still had not seen enough evidence to start bringing down rates.

However, since then policymakers have acknowledged that it soon will be appropriate to ease. Harker said policy will be made independently of political concerns as the presidential election looms in the background.

“I am very proud of being at the Fed, where we are proud technocrats,” he said. “That’s our job. Our job is to look at the data and respond appropriately. When I look at the data as a proud technocrat, it’s time to start bringing rates down.”

Harker does not get a vote this year on the rate-setting Federal Open Market Committee but still has input at meetings. Another nonvoter, Kansas City Fed President Jeffrey Schmid, also spoke to CNBC on Thursday, offering a less direct take on the future of policy. Still, he leaned toward a cut ahead.

Schmid noted the rising unemployment rate as a factor in where things are going. A severe supply-demand mismatch in the labor market had helped fuel the run in inflation, pushing wages up and driving inflation expectations. In recent months, though, jobs indicators have cooled and the unemployment rate has climbed slowly but steadily.

“Having the labor market cool some is helping, but there’s work to do,” Schmid said. “I really do believe you’ve got to start looking at it a little bit harder relative to where this 3.5% [unemployment] number was and where it is today in the low 4s.”

However, Schmid said he believes banks have held up well under the high-rate environment and said he does not believe monetary policy is “over-restrictive.”

Harker next votes in 2026, while Schmid will get a vote next year.