Including 130 ft of 0.65% TCu and 138 ft of 0.62% TCu

August 21, 2024 11:58 AM EDT | Source: Lion Copper and Gold Corp.

Yerington, Nevada–(Newsfile Corp. – August 21, 2024) – Lion Copper and Gold Corp. (TSXV: LEO) (OTCQB: LCGMF) (“Lion CG” or the “Company“) today released results from its Bear deposit 2024 exploration drilling program in the Yerington District of Nevada. As a second phase of drilling subsequent to the exploration drilling in 2023 (see Oct 27, 2023, news release), an additional US$1,500,000 (total US$4,000,000) was funded as early advance of the Stage 3 funding for exploration under the Company’s agreement with Nuton LLC, a Rio Tinto venture (see December 22, 2023, new release).

Bear Deposit 2024 Drilling Highlights

Diamond core drill hole B-056A encountered 2,376 ft of 0.40% TCu, including 130 ft of 0.65% TCu and 138 ft of 0.62% TCu collared midway between legacy Anaconda drill holes B-014 and B-022

Diamond core drill hole B-055, collared 2,750 ft southwest from drill hole B-054, encountered weak copper mineralization along the far western edge of the known deposit

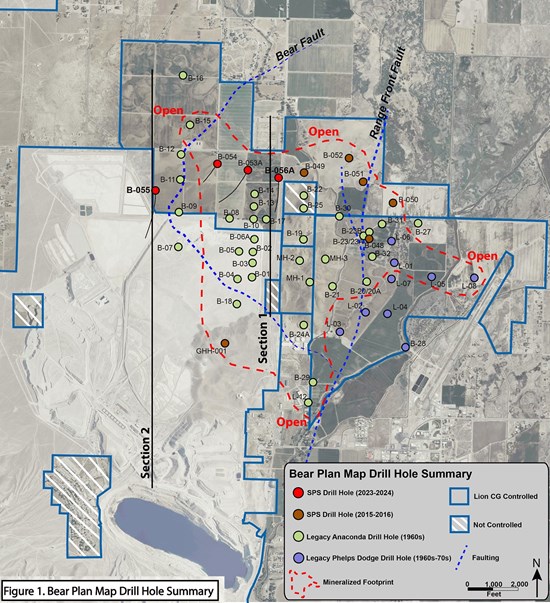

B-056A is a deep, angle drill hole located along a northwest trend of elevated copper grades defined by legacy Anaconda drilling. Drill hole B-055 is coincident with a strong Induced Polarization (IP) anomaly identified during the recent IP survey completed in late 2023. B-056A returned a significant drill intercept of 0.40% TCu over 2,376 ft from a depth of 1,237 ft and ending in final two intervals of 1.150 TCu% and 0.904 TCu%. Figure 1 shows the location of Bear drill holes and Figure 2 shows a cross section through drillhole B-056A.

Steven Dischler, Lion CG’s CEO, states, “The thick intervals of copper mineralization encountered in our latest drilling of B-056A highlights the tremendous size and potential of the Bear deposit. The wide intercepts of copper mineralization throughout the Bear porphyry system are encouraging and continue to support our fundamental view that continued systematic exploration has potential to unlock substantial new zones of high-grade copper mineralization and further expand and upgrade the footprint of the deposit.”

Bear Deposit 2024 Drilling Details

Two diamond core drill holes, B-055 and B-056A were angle drilled to depths of 3,435 ft and 3,613 ft, respectively. Following the 2023 drilling, an IP/resistivity survey was completed that identified the strongest IP anomaly in the Company and Anaconda archives that is known in the Bear deposit area. B-055, drilled on the far western edge of known mineralization, was directed to intersect this very strong and thick 40 to +55 milliradian IP anomaly (see Figure 3). B-055 cut several narrow zones of weak copper mineralization within a thick 2,330 ft intercept of sulfide mineralization from a depth of 1,105 ft. The drill intercept of sulfide mineralization coincides with the IP anomaly, although the 2% sulfide is lower than predicted by the IP anomaly. The source of the IP anomaly is unconfirmed with drilling; however, this may represent the high pyrite cap of the Bear deposit and remains subject to consideration for future exploration.

B-056A was drilled to test a wide spaced drilling gap along the northwest mineralization trend identified previously by Anaconda legacy and SPS 2023 drill holes. B-056A returned a significant drill intercept of 0.40% TCu over 2,376 ft from a depth of 1,237 ft. The final two intervals of B-056A ended in grades of 1.150 TCu% and 0.904 TCu%. Drill hole B-056 was abandoned at depth due to borehole collapse in high grade copper. A total of 16 sample intervals reported values between 1.01 to 2.09 TCu%. Four drill intervals, for a combined length of 23.5 ft, had no sample recovery adjacent to these high-grade intervals.

B-056A is the 2nd best grade-thickness intercept made to date at Bear and attests to the strength and scale of the mineralization (Table 1 and Table 2). Quartz-chalcopyrite veining is the dominant form of sulfide mineralization, with quartz vein percentages ranging from 1% to 5%. Within these zones, potassic alteration is dominant, defined by abundant secondary biotite and lesser potassium feldspar flooding. Veining typically dips 40-50° to the north northeast and correlates closely with quartz monzonite porphyry dikes also having typical 40-50° north northeast dips as determined by oriented core measurements. The presence of the large grade-thickness intercept, the potassic alteration, and quartz veining percentages are interpreted to indicate B-056A may occur near the core of the deposit. Figure 2 shows the results of B-056A in relation to previous drilling along a north-south Section 1.

The size and strength of mineralization in the Bear deposit is highly permissive for further exploration given the exceptionally large footprint of the known mineralization, multiple 1-2% TCu intervals within thick mineralized zones, and current widely spaced drilling at 500-to-1,000-foot intervals. In the central zone where B-022, B-056A, and B-006 and the highest grade-thickness values are located, exploration drill tests are compelling in locations along the west-northwest identified strike as well as up-dip and down-dip following the quartz monzonite porphyry dikes.

Background of the Bear Deposit

The Bear deposit is a large and partially defined porphyry copper exploration target located primarily on private lands approximately 3 miles north of Anaconda’s former Yerington open pit and 2.6 miles southeast of the MacArthur open pit, in Lyon County, Nevada. The Bear deposit was previously jointly held by The Anaconda Copper Mining Company (“Anaconda”), one of the largest copper mining companies of the 20th century, and Phelps Dodge Corporation (“Phelps Dodge”, now Freeport-McMoRan). Lion CG, through its wholly owned subsidiary Singatse Peak Services, LLC (“SPS”), is the first company to consolidate the property through private land option agreements and controls a land position of approximately 2,330 acres over the Bear deposit.

The Bear deposit was first identified by Anaconda in 1961 and has a long history of drilling development including Anaconda (1961-1967), Phelps Dodge (1969-1973), and a SPS program funded by Freeport Nevada LLC (2015-2016). Drilling by Anaconda, Phelps Dodge, and SPS all intersected zones of copper mineralization ranging from 490 ft to 2,843 ft thick (Table 1). In 2023, SPS angle drilled B-053A and B-054 northwest along the mineralization trend previously identified by Anaconda legacy drill holes (Figure 1). For additional details on the drilling background of the Bear deposit please see October 27, 2023, news release.

The Bear deposit has a similar regional geologic setting to other Jurassic-aged porphyry-style copper deposits in the Yerington district, including the Yerington mine, MacArthur, and Mason deposits. The Yerington mine was operated by Anaconda from 1951 through 1978, extracting 1,744,237,000 lbs. of copper.

The footprint of the Bear deposit extends 2.5 miles (4 km) in length in a northwest-southeast direction and 1.7 miles (2.7 km) in length in the northeast-southwest direction (Figure 1). Mineralization at the Bear is concealed under approximately 200 to 1,200 ft of post-mineral alluvial and Tertiary volcanic cover.

Results of angled drill hole B-053A, B-054, and B-056A demonstrate the structural control and orientation of the mineralized zones. The quartz monzonite porphyry dikes and associated mineralization strike roughly east-west to northwest-southeast with a northerly dip as shown in the cross-section (Figure 2). Mineralization at the Bear is interpreted to include a first pulse associated with the intrusion of quartz monzonite into the granodiorite and characterized as calc-silicate alteration along the contact of the older host rocks of granodiorite and younger quartz monzonite. A second pulse of mineralization is represented, where quartz monzonite porphyry dikes intrude into the quartz monzonite and mineralized veins formed in zones in and along the margins of the porphyry dikes. The main copper sulfide mineral is chalcopyrite, with lesser bornite which typically occur within veins and as disseminations. The zones of primary sulfide mineralization remain open in several directions where the limits of mineralization are not closed off by drilling. No zones of oxide mineralization or supergene enrichment have been identified at the Bear deposit.

Quality Assurance & Control

All samples were collected via diamond core drilling by Alford Drilling, LLC (of no relation to Tony Alford, a director of the Company) of Elko, NV. Core samples were sawed on the Yerington Property site by Company personnel. All samples were picked up by Skyline Assayers & Laboratories (“Skyline”), Tucson, AZ and transferred for crushing, splitting, and pulverizing sample preparation. Multi-element (47 el.) analyses were completed using a multi-acid digestion and ICP OES/ICP-MS finish (Skyline’s TE-5 method). Commercially prepared certified reference materials and blanks were inserted by the Company at 50-ft intervals to ensure precision of results as a quality control measure. The Company also applied a chain of custody program to confirm sample security during all stages of sample collection, shipment, and storage.

About Lion CG

Lion Copper and Gold Corp. is a Canadian-based company advancing its flagship copper assets at Yerington, Nevada through an Option to Earn-in Agreement with Nuton, a Rio Tinto venture.

About Nuton

Nuton is an innovative venture that aims to help grow Rio Tinto’s copper business. At the core of Nuton is a portfolio of proprietary copper leach related technologies and capability – a product of almost 30 years of research and development. Nuton™ offers the potential to economically unlock copper from primary sulfide resources through leaching, achieving market-leading recovery rates, contributing to an increase in copper production from copper bearing waste and tailings, and getting higher copper recoveries on oxide and transitional material. One of the key differentiators of Nuton is the potential to produce the world’s lowest impact copper while having at least one Net Positive impact at each of our deployment sites, across our five pillars: water, energy, land, materials and society.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

The technical information in this news release has been reviewed and approved by C. Travis Naugle, QP MMSA, Co-Chairman of Lion Copper and Gold Corp. and a qualified person as defined in NI 43-101.

Certain information in this news release constitutes forward-looking statements under applicable securities laws. Any statements that are contained in this news release that are not statements of historical fact may be deemed to be forward-looking statements. Forward-Looking statements are often identified by terms such as “may”, “expect”, or the negative of these terms and similar expressions. Forward-Looking statements in this news release include, but are not limited to, statements with respect to the future exploration activities and anticipated results. Forward-Looking statements necessarily involve known and unknown risks, including, without limitation, risks associated with exploration activity; general economic conditions; adverse industry events; marketing costs; loss of markets; future legislative and regulatory developments; inability to access sufficient capital from internal and external sources, and/or inability to access sufficient capital on favorable terms; the ability of Lion CG to implement its business strategies; competition; currency and interest rate fluctuations and other risks.

Figure 1. Bear Plan Map Drill Hole Summary

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1020/220670_ea4dde34f4680aed_001full.jpg

Figure 2. North-South Geologic Section Looking West

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1020/220670_ea4dde34f4680aed_002full.jpg

Figure 3. North-South IP Section Looking West

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1020/220670_ea4dde34f4680aed_003full.jpg

Table 1. Bear Deposit Drill Hole Intercepts

Company

Year

Drill Hole

Northing (UTM NAD 27)

Easting (UTM NAD 27)

Elevation (ft)

Inclination

Azimuth

Total

Depth (ft)

From feet

To

feet

Interval feet

% TCu

Interval X %TCu (GXT)

Anaconda

1961

B-01

310817.1

4320219.4

4360.1

-90°

–

2533

896

2,139

1,243

0.19

236

Anaconda

1962

B-02

310829.3

4320527.1

4357.3

-90°

–

2509.6

1,209

2,510

1,301

0.38

494

Anaconda

1962

B-03

310824.9

4320393.4

4358.4

-90°

–

864

Too Shallow

Anaconda

1962

B-04

310641.8

4320201.1

4355.2

-90°

–

557

Too Shallow

Anaconda

1963

B-05

310659.8

4320533.1

4357.3

-90°

–

1784.9

1,050

1,235

185

0.32

59

Anaconda

1963

B-06A

310835.9

4320682.5

4357.9

-90°

–

3516.2

1,590

3,288

1,698

0.39

662

Anaconda

1963

B-07

309923.9

4320588.8

4359.9

-90°

–

1982

Outside Mineralized Footprint

Anaconda

1963

B-08

310546.5

4320932.6

4363.9

-90°

–

3607.1

1,377

2,650

1,273

0.29

369

Anaconda

1963

B-09

309929.9

4320953.4

4353.0

-90°

–

2149

Too Shallow

Anaconda

1963

B-010

310836.7

4320925.2

4358.3

-90°

–

3709.3

1,736

3,392

1,656

0.38

629

Anaconda

1963

B-011

309949.8

4321404.2

4346.0

-90°

–

2148

Outside Mineralized Footprint/Too Shallow?

Anaconda

1963

B-012

309957.1

4321708.9

4347.4

-90°

–

1458

Outside Mineralized Footprint/Too Shallow?

Anaconda

1963

B-013

310840.3

4321077.6

4358.0

-90°

–

3680.4

1,929

3,436

1,507

0.42

633

Anaconda

1964

B-014

310850.4

4321229.8

4362.7

-90°

–

3650.4

1,355

3,370

2,015

0.32

645

Anaconda

1964

B-015

310065.6

4322067.0

4343.2

-90°

–

3166

2,163

2,458

295

0.28

83

Anaconda

1965

B-016

309980.1

4322669.5

4339.9

-90°

–

2096.7

Outside Mineralized Footprint

Anaconda

1964

B-017

310988.8

4320921.5

4358.9

-90°

–

3703.4

1,319

3,703

2,384

0.38

906

Anaconda

1965

B-018

310634.5

4319894.3

4382.9

-90°

–

2015.9

Outside Mineralized Footprint

Anaconda

1965

B-019

311442.8

4320678.7

4400.0

-90°

–

3329.3

2,510

3,329

819

0.26

213

Anaconda

1965

B-20A

312209.9

4320167.1

4366.5

-90°

–

2506.6

1,429

2,256

827

0.31

256

Anaconda

1966

B-021

311794.0

4320109.1

4412.0

-90°

–

4019

1,133

3,976

2,843

0.21

597

Anaconda

1966

B-022

311447.9

4321210.8

4422.2

-90°

–

4418.6

1,632

4,012

2,380

0.43

1,023

Anaconda

1966

B-023B

312241.2

4320768.7

4365.0

-90°

–

3059.1

1,597

2,649

1,052

0.50

526

Anaconda

1967

B-024

311445.2

4319640.1

4413.2

-90°

–

4793

2,781

4,211

1,430

0.30

429

Anaconda

1967

B-025

311443.7

4321054.5

4449.0

-90°

–

4340

1,815

3,323

1,508

0.30

452

Anaconda

1967

B-027

312830.1

4320876.1

4364.0

-90°

–

3833.8

Outside Mineralized Footprint

Anaconda

1967

B-028

312679.0

4319370.6

4371.0

-90°

–

2840

Outside Mineralized Footprint

Anaconda

1967

B-029

311558.2

4318945.3

4373.0

-90°

–

2743.5

937

1,514

577

0.27

156

Anaconda

1967

B-030

311878.5

4320958.8

4370.0

-90°

–

3177.5

No Significant Intercept

Anaconda

1967

B-031

312395.0

4320864.9

4365.0

-90°

–

3008

2,474

2,964

490

0.55

270

Anaconda

1967

B-032

312277.3

4320469.6

4366.0

-90°

–

2403

1,169

2,403

1,234

0.28

346

Anaconda

1961

MH-1

311533.7

4320162.2

4524.1

-90°

–

1167.1

Too Shallow

Anaconda

1961

MH 2

311403.8

4320418.8

4454.4

-90°

–

2374

1,802

2,374

572

0.17

97

Anaconda

1961

MH-3

311707.5

4320438.1

4510.0

-90°

–

102

Too Shallow

Phelps Dodge

1969

L-01

312560.6

4320386.7

4378.1

-90°

–

3742.2

2,800

3,470

670

0.40

268

Phelps Dodge

1969

L-02

312243.7

4319807.5

4380.6

-90°

–

2297

1,360

1,900

540

0.42

227

Phelps Dodge

1970

L-03

311997.8

4319561.7

4381.8

-90°

–

3243.5

1,277

1,893

616

0.18

111

Phelps Dodge

1970

L-04

312495.0

4319796.6

4379.0

-90°

–

2980

Outside Mineralized Footprint

Phelps Dodge

1970

L-05

312997.7

4320266.5

4375.0

-90°

–

3900

2,900

3,900

1,000

0.40

400

Phelps Dodge

1970

L-06

312511.1

4320660.0

4377.3

-90°

–

2983

No Significant Intercept

Phelps Dodge

1970

L-07

312500.5

4320173.6

4378.6

-90°

–

3249

Outside Mineralized Footprint

Phelps Dodge

1970

L-08

313478.6

4320244.7

4373.4

-90°

–

3004

1,660

2,290

630

0.40

252

Phelps Dodge

1973

L-12

311336.6

4318753.0

4394.7

-90°

–

2305

820

1,320

500

0.31

155

SPS

2016

GHH-001

310543.2

4319490.5

2017.5

-90°

–

2017.5

Outside Mineralized Footprint

SPS

2015

B-048

312243.5

4320761.2

4368.3

-90°

–

3438

1,573

2,731

1,158

0.42

486

SPS

2015

B-049

311446.2

4321445.9

4358.4

-90°

–

3635

1,588

2,926

1,338

0.22

294

SPS

2015

B-050

312341.5

4321073.8

4366.0

-90°

–

3838

2,429

2,951

522

0.36

188

SPS

2016

B-051

311798.2

4321411.0

4366.4

-90°

–

3878

2,191

3,675

1,484

0.26

386

SPS

2016

B-052

311881.7

4321613.0

4360.3

-90°

–

3468

2,081

2,748

667

0.14

93

SPS

2023

B-053A

310778.0

4321510.0

4351.0

-60°

210

3503

2,212

3,138

926

0.31

287

SPS

2023

B-054

310406.0

4321602.0

4364.0

-70°

205

3458

2,311

3359

1,048

0.26

272

SPS

2024

B-055

309644.0

4321234.0

4350.0

-60°

180

3435

Outside Mineralized Footprint

SPS

2024

B-056A

311175.0

4321411.0

4350.0

-65°

190

3613

1,237

3,613

2,376

0.40

950

Table 2. Significant Drill Hole Intercepts B-055 and B-056A

Drill Hole

Northing

(UTM NAD 27)

Easting

(UTM NAD 27)

Elevation (ft)

Inclination

Azimuth

From feet

To feet

Interval

feet

%

TCu

Mineralization Type

B-055

309644.0

4321234.0

4350.0

-60°

180

1,466.0

1,481.0

15

0.19

Vein-hosted

1,693.0

1,697.0

4

0.82

Vein-hosted

2,628.0

2,636.0

8

0.81

Vein-hosted

3,272.0

3,288.0

16

0.29

Vein-hosted

B-056A

311175.0

4321411.0

4350.0

-65°

190

1,237.0

3,613.0

2376

0.40

includes

1,740.0

1,870.0

130

0.65

Vein-hosted

and

2,054.5

2,098.0

43.5

0.72

Vein-hosted

and

2,218.5

2,356.5

138

0.62

Disseminations

and

2,778.5

2,825.0

46.5

0.68

Endoskarn

and

3,163.0

3,260.0

97

0.60

Vein-hosted

and

3,418.0

3,470.0

52

0.68

Vein-hosted

and

3,603.5

3613 TD

9.5

0.94

Disseminations

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/220670

SOURCE: Lion Copper and Gold Corp.

The post Lion Copper and Gold Announces Yerington Bear Deposit Diamond Drill Results, Hole B-056A Encountered 2,376 ft of 0.40% TCu appeared first on Invezz